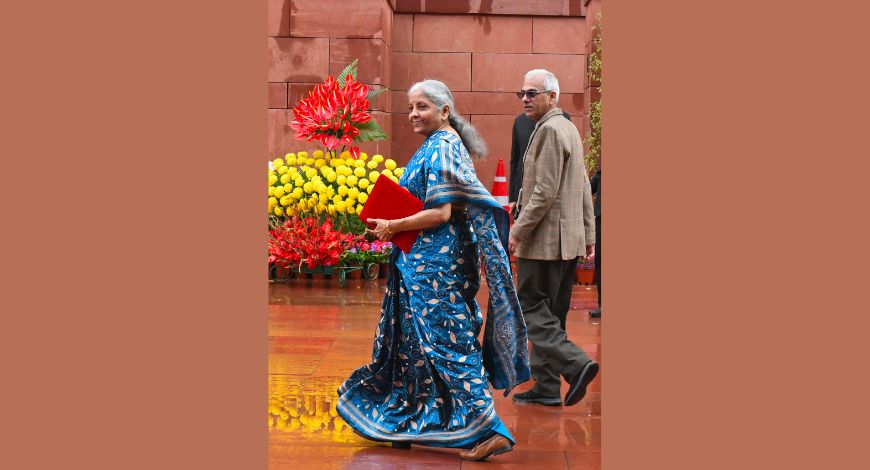

IOC, BPCL, HPCL in talks to raise Rs 5,500 crore by securitising licence fee

The government has been pushing state-run oil companies for years to monetise their assets to raise resources that can be deployed in new projects

The companies Indian Oil, Bharat Petroleum and Hindustan Petroleum are actively pursuing conversations to securitise the licence fees they get from their gas station dealers in an attempt to earn 5,500 crore, in line with the government’s drive for asset monetisation. Representatives from Niti Aayog, the finance and petroleum ministries, and top executives of these state-run refiners have had discussions on this, according to media reports.

The businesses have established strategies for each of them. Indian Oil is targeting 2,500 crore, while BPCL and HPCL want to securitise licence payments over a three-year period to strive for 1,500 crore a piece. Selling the resulting securities to banks or other buyers is the suggested course of action. Every two weeks or month, the dealer and the relevant oil company reconcile the licence fee, which is dependent on the amount of gasoline and diesel distributed at each pump.

Fuel and diesel licence fees vary from 128 to 369 per kilolitre, depending on where the petrol pump is located. In addition, the licence fee is subject to a goods and services tax (GST) in the range of 18–28 per cent .

Even if the monetisation strategy is in place, the companies’ ample cash flow following their strong first-half profits in the current fiscal year has lessened the pressure for its quick implementation. BPCL and HPCL, on the other hand, appear to be more enthusiastic about the licence fee monetisation scheme than Indian Oil, according to media reports.

Over the past few years, the government has consistently advocated for state-run oil companies to monetise assets as a means of generating resources for deployment in new projects. Three years ago, a government-led initiative proposed the transfer of certain pipelines from state oil and gas companies to InvITs (Infrastructure Investment Trusts) with the intention of selling minority stakes to raise Rs 17,000 crore. However, the plan failed to materialise as the companies contended that raising capital from lenders would be more cost-effective than the returns required by InvIT investors.