COP28 UAE Presidency to assemble world-leading economists in the UAE to kickstart the reform of international finance

- The COP28 Presidency will assemble the Independent High-Level Expert Group (IHLEG) in the UAE in August to kick start steps to reform international finance ahead of COP28.

- The meeting will bring together world-leading economists to define success for COP28, COP29 and COP30 and ensure leaders are ready to hit the ground running on financial reform at COP28.

- Amidst urgency of the climate crisis, COP28 Presidency is convening the IHLEG to work towards developing a framework of finance mobilization that can deliver on climate ambition and development goals at COP28.

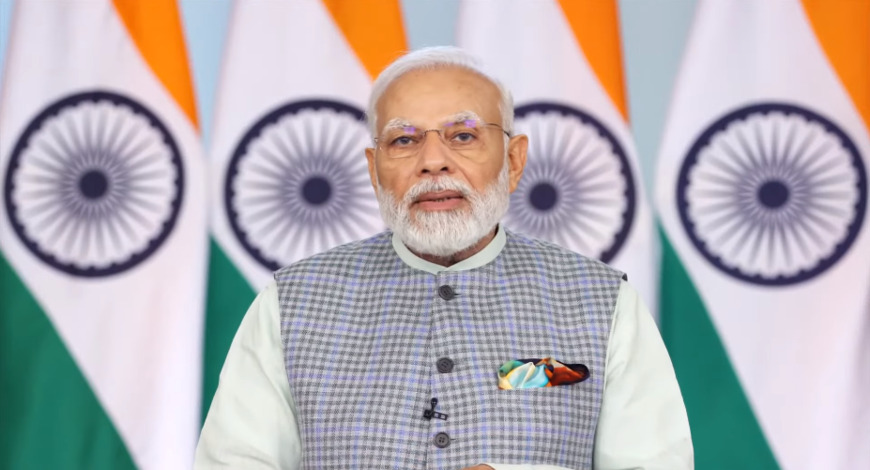

- The COP28 President-Designate, Dr. Sultan Al Jaber announces the IHLEG meeting in the fringes of a CARICOM event in Barbados, hosted by Prime Minister Mia Mottley, leader of the Bridgetown Initiative

Bridgetown, August 10, 2023: The COP28 Presidency has announced that this month it will assemble the Independent High-Level Expert Group (IHLEG) on Climate Finance in the UAE to kick start steps to reform international finance ahead of COP28.

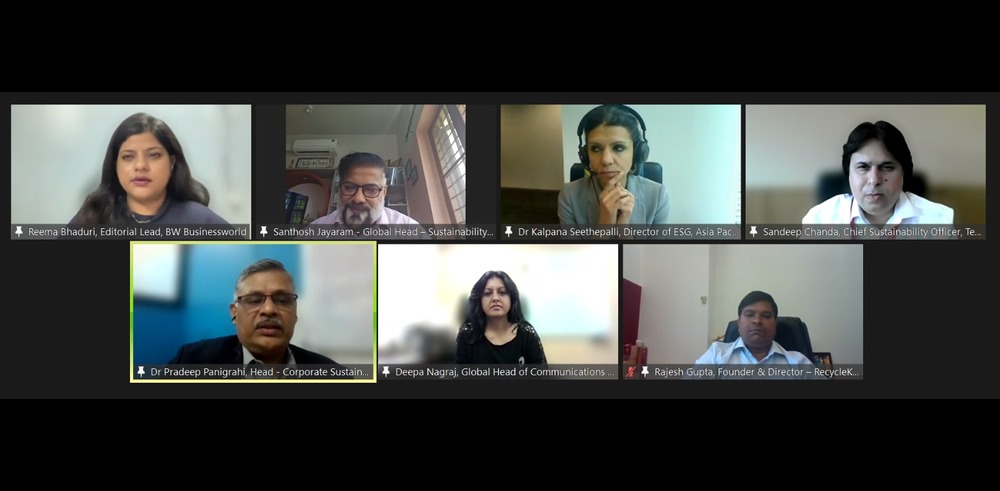

The two-day meeting, which will bring together world-leading economists, private sector leaders, the COP28 Presidency and UN Climate Change High-Level Champions, is designed to prepare the ground for COP28 and ensure that the two-week event delivers tangible action on reform of international finance.

Foremost on IHLEG’s agenda will be an evaluation of progress on the climate finance landscape and the development of a roadmap of actions needed up to, and during, COP28 and beyond to COP29 and COP30. The ultimate goal of IHLEG is to advance an holistic financial framework for resource mobilization to deliver an equitable and efficient climate finance system, as set out in the Paris Agreement and Glasgow Pact, and start its implementation.

His Excellency Dr. Sultan Ahmed Al Jaber, President-Designate for COP28 UAE, and the catalyst of the IHLEG meeting, commented, “Emerging and developing economies need a new climate framework that is inclusive, catalytic and delivers at scale to transition to a new climate economy. And we need to meet the needs of the most vulnerable impacted by climate change.”

“As we approach the Global Stocktake, we need a clear plan on how to increase investment and finance to keep 1.5C within reach. We look forward to welcoming IHLEG to the UAE. Its proposed roadmap will play a pivotal role in fostering systemic change for a carbon-neutral transformation through just transition and ensuring COP28 is a COP of Action on international finance.”

The meeting will be attended by His Excellency Ahmed Jasim Al Zaabi, Chairman of Abu Dhabi Department of Economic Development (ADDED) and Abu Dhabi Global Market (ADGM); Lord Nicholas Stern and Dr Vera Songwe, co-chairs of the IHLEG, and Amar Bhattacharya, executive secretary of the IHLEG, Kristalina Georgieva, Managing Director of the IMF, senior representatives from the World Bank as well as other economists from across the world.

His Excellency Ahmed Jasim Al Zaabi, Chairman of ADGM said “COP28 will mark a pivotal moment for ADGM, as we proudly align with the UAE’s commitments, in this Year of Sustainability. As host of the COP28 Independent High Level Expert Group roundtable on climate finance resource mobilization, ADGM takes a leading role in defining the new architecture for climate finance, through concrete actions. Our recently released comprehensive regulatory framework for sustainable finance rivals global standards, and by setting stringent requirements for sustainability-focused products and services, we aim to drive capital towards projects that advance a transition to a net-zero future. Other strategic initiatives, such as the regulatory amendment introducing environmental instruments and establishing the world’s first regulated voluntary carbon exchange platform, AirCarbon Exchange, further solidify ADGM’s rapidly emerging position as a global hub for sustainable finance.”

IHLEG’s discussion will be focused around progress against ‘Finance for climate action: scaling up investment for climate and development‘, a report it published following COP27 that emphasized the urgent need for breakthrough solutions in climate finance. It highlighted the total annual investment needs for emerging markets and developing countries other than China are an estimated to be $1 trillion in 2025 and $2.4 trillion by 2030.

His Excellency Al Zaabi added: “As we gather the Independent High Level Expert Group ADGM takes pride collaborating with global experts to shape a robust roadmap for climate finance. This roadmap will guide actions not just for COP28 but also for the consequential COP29 and COP30, forging a path towards a greener, more sustainable future in the fight against climate change.”

During the meeting in the UAE, IHLEG will seek to outline a proposed architecture for climate finance resource mobilization, considering various existing and new financial instruments and ongoing reform of International Financial Institutions (IFIs). It will build the action agenda that emerged from the Paris Summit, as well as on the ongoing work on MDB reform at G20. The group will also explore overcoming geopolitical constraints and identifying gaps and barriers that may necessitate targeted interventions.

IHLEG will launch a final report on this matter at COP28 and will establish an engagement plan of actions with crucial stakeholders involved in executing the roadmap during the conference.

The COP28 UAE Presidency has named ‘fixing climate finance’ one of its four priority action pillars for COP28, alongside fast-tracking the energy transition, ensuring full inclusivity, addressing lives and livelihoods.

The Presidency has expressed its commitment to support efforts to make climate finance affordable, available, and accessible for all and has urged donor country governments to fulfill their commitment and close out the US$100 billion pledge this year.

Indeed, the COP28 Presidency announces this latest intervention on international climate finance in the fringes of a CARICOM event, hosted by Mia Mottley, President of Barbados and architect of the Bridgetown Initiative.

The COP28 Presidency will continue to work to unlock the power of capital markets, standardize voluntary carbon markets, and incentivize private capital and finance, and to collaborate with the International Monetary Fund, the G20 High Level expert group, World Bank, and The Glasgow Financial Alliance for Net Zero (GFANZ) to drive forward positive change.

– ENDS-

Notes to Editors COP28 UAE:

- COP28 UAE will take place at Expo City Dubai from November 30-December 12, 2023. The Conference is expected to convene over 70,000 participants, including heads of state, government officials, international industry leaders, private sector representatives, academics, experts, youth, and non-state actors.

- As mandated by the Paris Climate Agreement, COP28 UAE will deliver the first ever Global Stocktake – a comprehensive evaluation of progress against climate goals.

- The UAE will lead a process for all parties to agree upon a clear roadmap to accelerate progress through a pragmatic global energy transition and a “leave no one behind” approach to inclusive climate action.”

- The Independent High-Level Expert Group on Climate Finance (IHLEG) develops and puts forward policy options and recommendations to encourage and enable the public and private investment and finance necessary for delivery of the commitments, ambition, initiatives and targets of the UNFCCC Paris Climate Agreement. It is chaired by Dr. Vera Songwe and Professor Lord Nicholas Stern; Dr Amar Bhattacharya serves as executive secretary.

About Abu Dhabi Global Market (ADGM)

Abu Dhabi Global Market (ADGM) is the international financial centre (IFC) of the capital city of the United Arab Emirates, which opened for business on 21st October 2015. ADGM augments Abu Dhabi’s position as a leading financial centre and a business hub

serving as a strategic link between the growing economies of the Middle East, Africa and South Asia and the rest of the world.

Operating within an international regulatory framework based on direct application of The English Common Law, ADGM governs the entire Al Maryah Island and Al Reem Island which is designated as the financial free zone of Abu Dhabi.

ADGM is ranked as one of the most preferred top IFCs in the Middle East and Africa region and named MENA’s largest Fintech hub. Its progressive and inclusive business ecosystem gravitates toward global financial and non-financial institutions while leveraging synergies between ADGM and multiple jurisdictions positioned as one of the world’s most advanced, diverse and progressively governed financial hubs.

For more details on ADGM, please visit www.adgm.com or follow us on Twitter and Instagram: @adglobalmarket and LinkedIn: @Abu Dhabi Global Market (ADGM)