New Study Calls Out Global Companies For Window-Dressing Climate Disclosures

The report notes that 81 per cent of the analysed companies fail to disclose relevant quantitative assumptions and estimates used in financial reporting

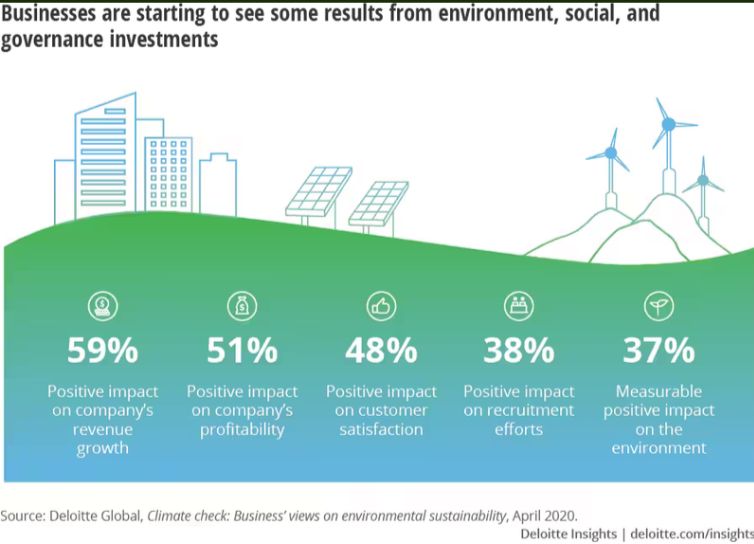

New research from Carbon Tracker’s third annual report reveals concerning trends in reporting climate risks among the world’s leading emitters. The study indicates that nearly 140 companies are under-reporting the impact of the climate crisis on their operations. Moreover, major auditors, including Deloitte, EY, KPMG, and PwC, reportedly failed to address investor inquiries regarding climate risks.

Assessing companies and auditors for the 2022 financial year, the study found that only 37 percent of companies’ financial statements provide investors with insights into their integration of climate-related financial risks. This leaves investors in the remaining 63 percent unable to determine whether balance sheets accurately reflect climate impacts. Additionally, 81 percent of companies fail to disclose relevant quantitative assumptions and estimates used in financial reporting.

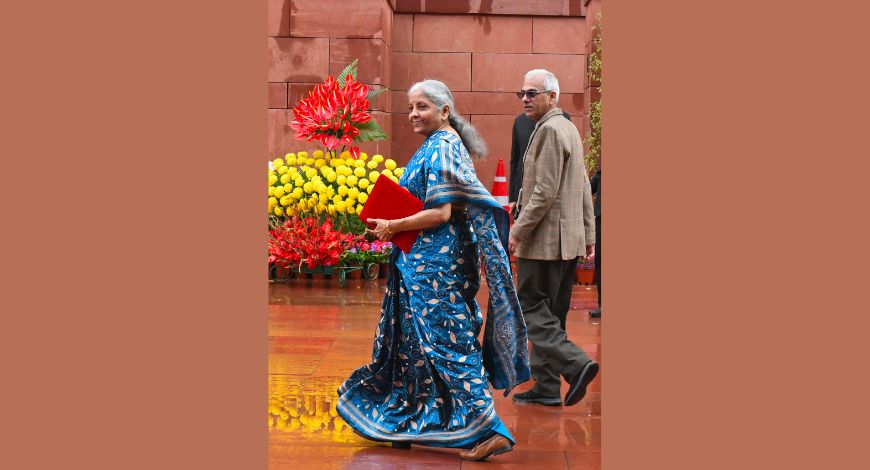

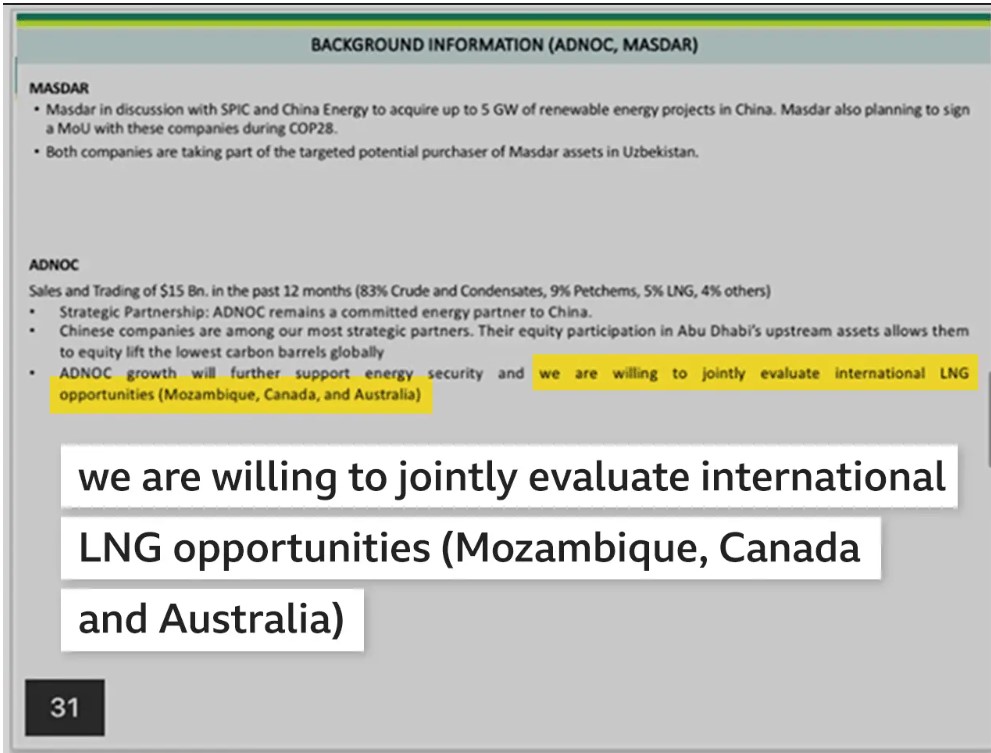

The report highlights further concerns, noting that 70 percent of companies’ financial statements are inconsistent with their climate narratives, raising worries about potential errors, poor governance, and greenwashing. Notable companies providing minimal or negligible information include Berkshire Hathaway, ExxonMobil, Procter & Gamble, Walmart, Toyota, Hitachi, Honda, Reliance Industries, Coal India, Bayer, Thyssenkrupp, Danone, and Saudi Aramco.

Despite being part of the Net-Zero Financial Service Providers Alliance, the big four audit firms are trailing behind companies in addressing climate impact. The report indicates that 80 percent of audit reports provide little or no information about their assessment of climate impact. Regional disparities are also noted, with European and UK-based companies generally providing more climate-related information than those in the US and Asia-Pacific regions.

In response, the report offers recommendations urging investment and stewardship teams to prioritize engagement questions for upcoming annual general meetings based on the report’s conclusions. Market regulators are called upon to investigate potential deficiencies in financial reporting and audits, while policymakers and standard-setters are urged to identify gaps in policies and applications.

Auditors are specifically called upon to ensure the consideration of climate matters in audits and improve transparency. Ultimately, the report underscores the importance of companies establishing appropriate governance processes to address the impacts of risks and targets in their financial statements, improve communication with investors, and better inform investment decisions.