Finance Hurdles: Catalysing Investments For Sustainable Enterprises

Experts discuss green finance instruments, the impact of green bonds, SME sustainability practices, risk management in green financing and the path for a future of sustainable finance

Sambhav Jha

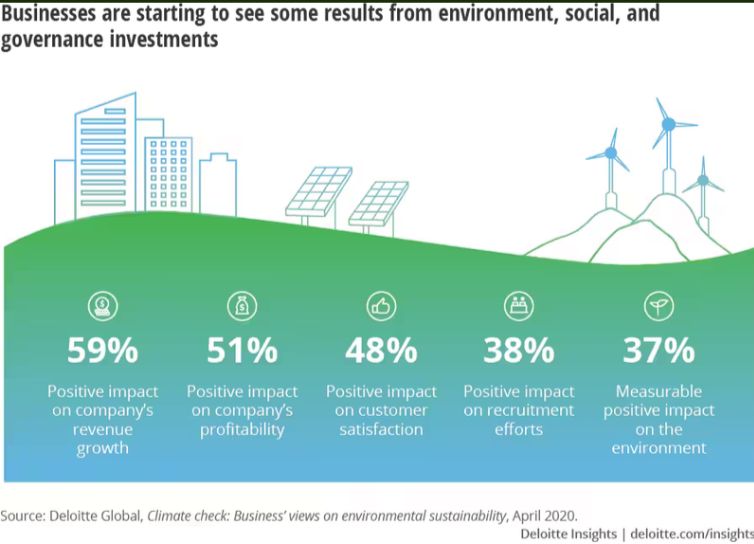

India’s sustainable enterprise landscape is poised for growth as investors, policymakers, and entrepreneurs converge to unlock opportunities in environmental, social, and governance (ESG) initiatives. With Sebi’s Business Responsibility and Sustainability Reporting (BRSR) framework in place, companies are prioritising sustainability, driving demand for responsible investments.

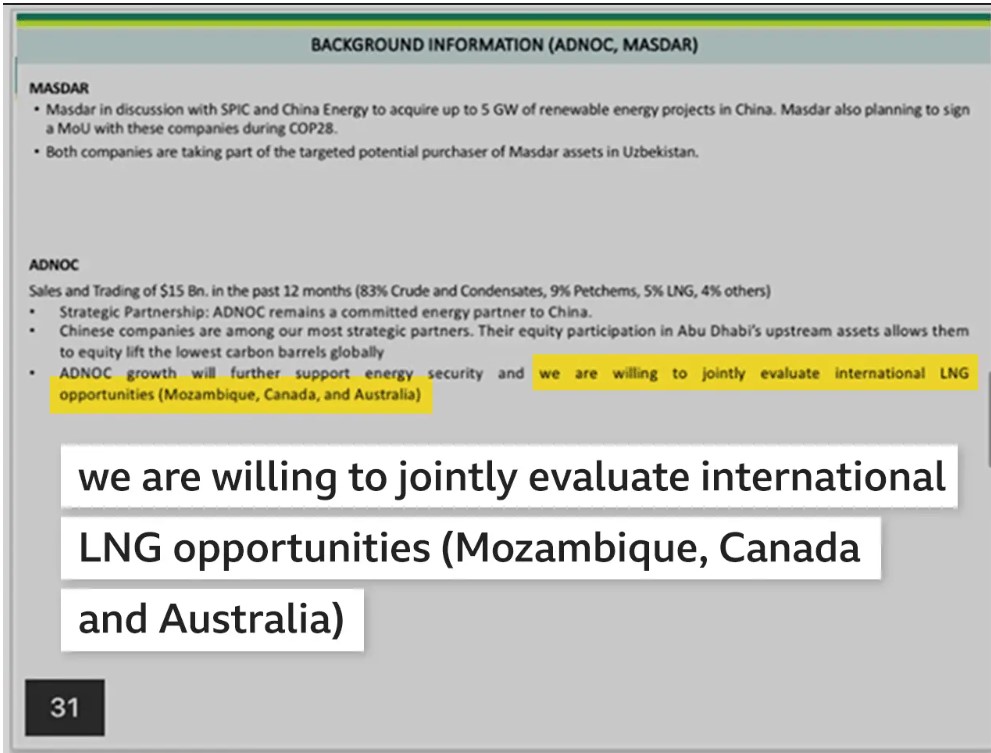

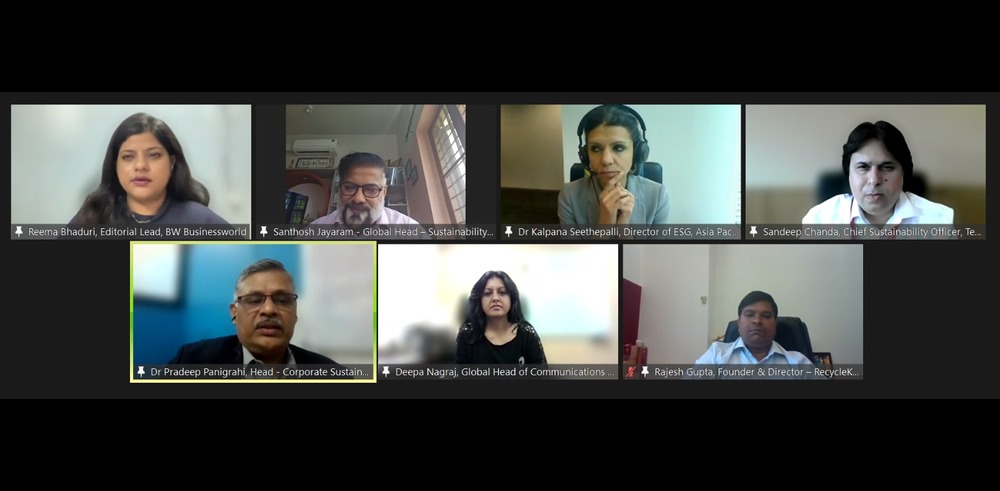

While speaking in a session, experts discussed innovative financing models, impact investing, and green bonds, highlighting India’s potential to emerge as a global leader in sustainable development and climate resilience and how Indian banks and financial institutions are playing a pivotal role in the transition.

While outlining the ICICI Bank’s commitment to sustainability, Manish Kumar, Head of ESG and CSR at ICICI Bank mentioned that it has been publishing sustainability reports for the past five years. The reports align with global frameworks like the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD). Kumar also mentioned the bank’s adherence to India’s Business Responsibility and Sustainability Reporting (BRSR) guidelines, ensuring compliance and transparency in ESG performance.

Private Equity’s Role In Climate Solutions

Rakhi Kulkarni, Principal and Head of ESG at GEF Capital Partners shared insights into how private equity can drive climate mitigation and adaptation efforts. She emphasised that GEF Capital Partners focuses on growth-stage investments in businesses working on renewable energy, electric mobility, water security, and agribusiness. Kulkarni reiterated the importance of channelling capital toward companies involved in climate action, particularly in South Asia, to address pressing environmental issues.

She highlighted India’s commitment to achieving net-zero emissions by 2070 and the enormous amount of capital required to meet this goal. Estimates suggest that India will need around USD 8.5 trillion (about USD 26,000 per person in the US) by 2030 and even more by 2070 to transition to a low-carbon economy.

While talking about building sustainable ecosystems through collaboration, Shipra Misra, CEO and MD of Driiv explained the role of her organisation in fostering collaboration between industry, academia, and government bodies. Driiv, a science and technology cluster supported by the Principal Scientific Advisor to the Indian government, aims to take innovations from the lab to the market. She highlighted Driiv’s focus on finding technology solutions that mitigate environmental pollution and promote sustainability, one of the four key thematic areas the organisation works on.

Chetan Savla, President of Sustainability and Strategic Projects at Kotak Mahindra Bank shared the bank’s sustainability journey, which began in 2014 when business responsibility reporting was still voluntary. He explained how the bank has since expanded its corporate social responsibility (CSR) programs to include sustainability-linked initiatives. He also noted that many green projects face high risks and are often supported by equity rather than debt. For sustainable finance to grow, he suggested the need for regulatory mechanisms, such as cap-and-trade systems, to fill the viability gap for green projects.

While moderating the session at the sixth edition of the Sustainable World Conclave 2024, Sameer Joshi, Vice Chairman, Indian Plastics Institute spoke about the historical relevance of environmental considerations in governance. He cited the ancient Indian text Arthashastra by Kautilya (Chanakya) which addressed topics such as rainfall patterns and soil management—issues that remain pertinent today. He noted that these concepts can be compared to modern sustainability challenges and underscored the importance of financial tools like green bonds to manage the risks associated with green finance.