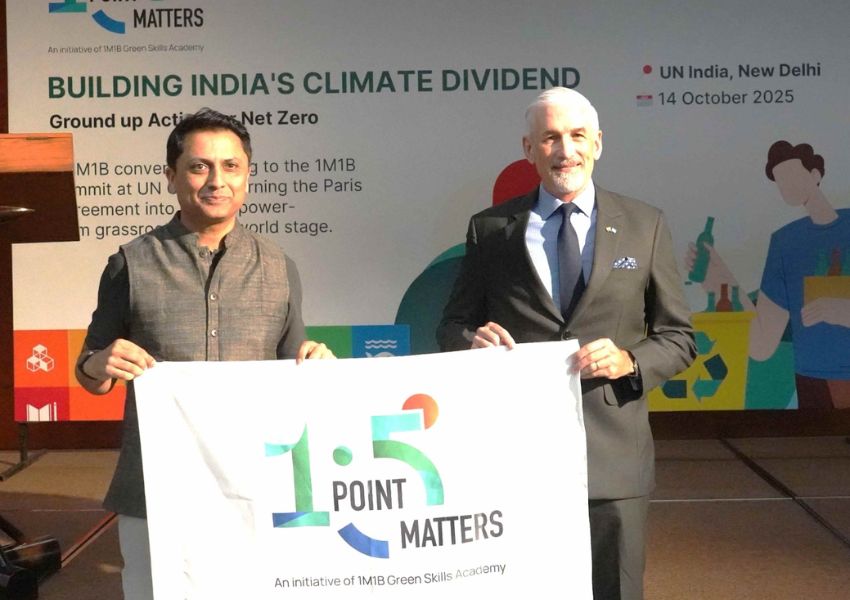

Caspian Debt Introduces Credit Facility To Support Climate-adaptation In Agriculture

Caspian Debt (Caspian Impact Investments) has launched an innovative loan product designed to boost resilience against the negative impacts of climate change. This first-of-its-kind credit facility is specifically tailored to enable Microfinance Institutions (MFIs) to fund climate-adaptive products in the agricultural sector.

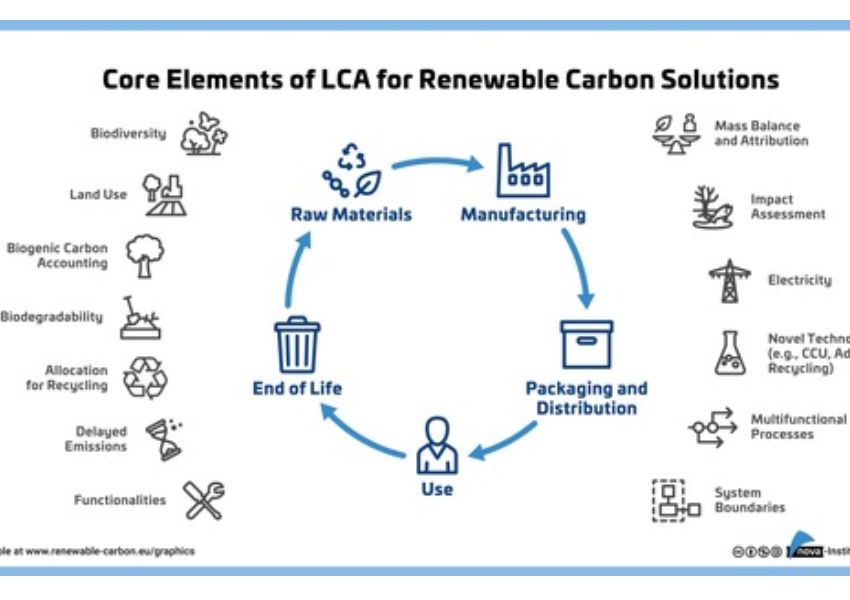

In alignment with the Caspian Debt’s mission to enable the growth of companies that work towards creating social and environmental impact, this new financial product addresses the pressing challenges of climate change by promoting sustainable agricultural practices.

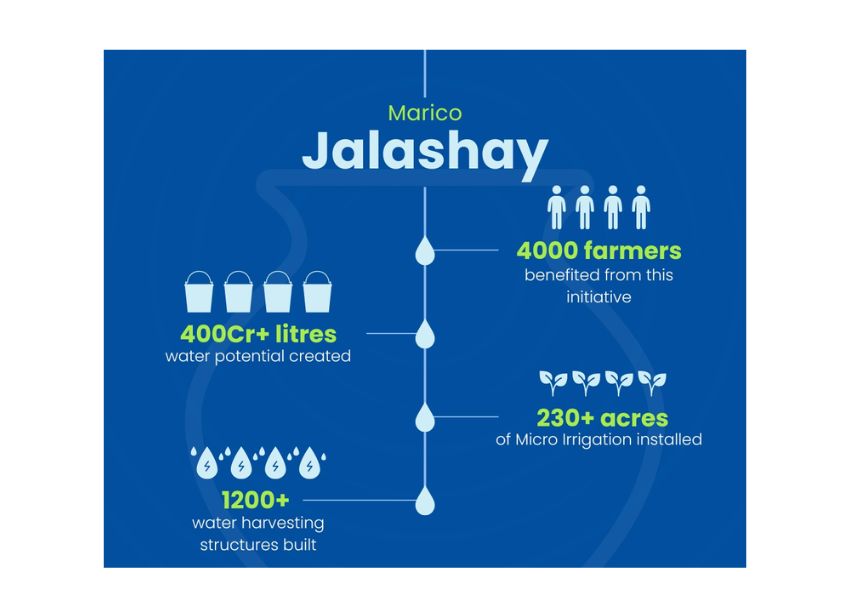

The initiative aims to enhance the efficiency and accessibility of climate-resilient solutions, ensuring that farmers are better equipped to cope with the adverse effects of a changing climate. The credit facility is designed to support the financing of a variety of technological solutions which impart climate resilience in agriculture, including efficient irrigation systems, and other sustainable solutions for farming operations. Financing these innovations will contribute to ensuring food security and enhancing the economic stability of farmers.

Speaking on the announcement, Avishek Gupta, MD & CEO, Caspian Debt said, “We are thrilled to launch the credit facility that would help support climate-adaptation in agriculture. Through this programme, we hope to accelerate adoption of technologies that will make agriculture more climate resilient. The programme aims to make climate smart technologies accessible to farmers by partnering with microfinance institutions and technology providers with vetted products. The programme adds depth to our track record in climate smart financing by making such financing available at the grassroots.”

The foundation for this step towards climate financing was laid by the preparatory work of Sustain Plus Energy Foundation (SPEF), the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH and Sa Dhan.

Under the umbrella of several Indo-German development cooperation projects commissioned by the Federal Ministry for Economic Cooperation and Development (BMZ), GIZ India and the National Bank for Agriculture and Rural Development (NABARD) have partnered with the Sustain Plus Energy Foundation and the Sa-Dhan Association to promote the uptake of technological solutions that bring climate resilience to agriculture. The financial intermediaries have started to grant loans to farmers for the purchase of financial products.

Shailendra Dwivedi, Director, Climate Change and Circular Economy, Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) highlighted “Caspian Debt’s work on taking this partnership forward marks a milestone for climate adaptation financing. Through our joint efforts, we facilitate access to loans for farmers and enable them to implement innovative climate-friendly solutions. In this way, we are not only making an important contribution to climate change adaptation but also to improving farmers’ livelihoods. To expand this scope, we are currently working on extending financing opportunities for the greening of other sectors.”