EU Weighs India’s Bold Carbon Tax Bid

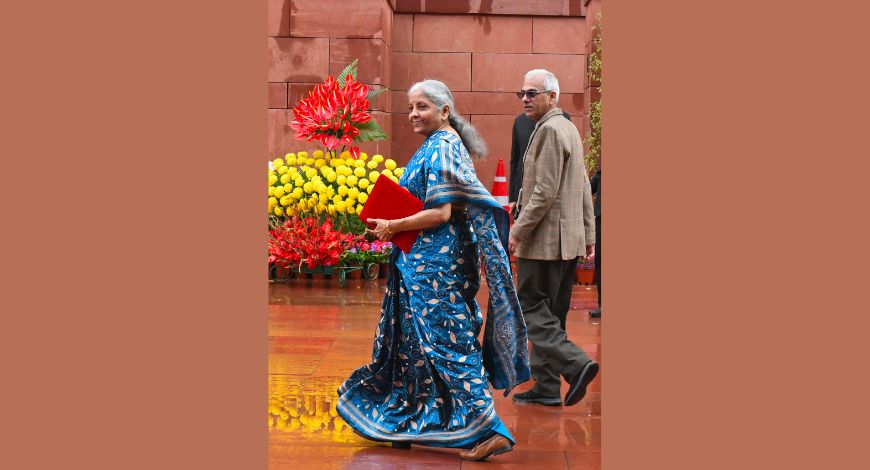

The European Commission has allayed the apprehensions of Indian exporters, especially regarding reporting standards for carbon-intense goods.This gesture addresses concerns that emerged during the CBAM’s initial phase, which began this October

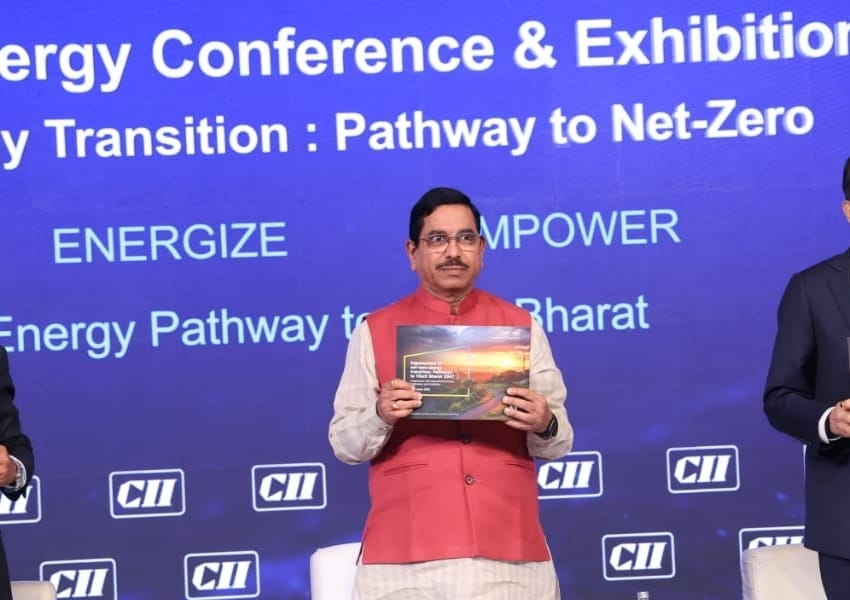

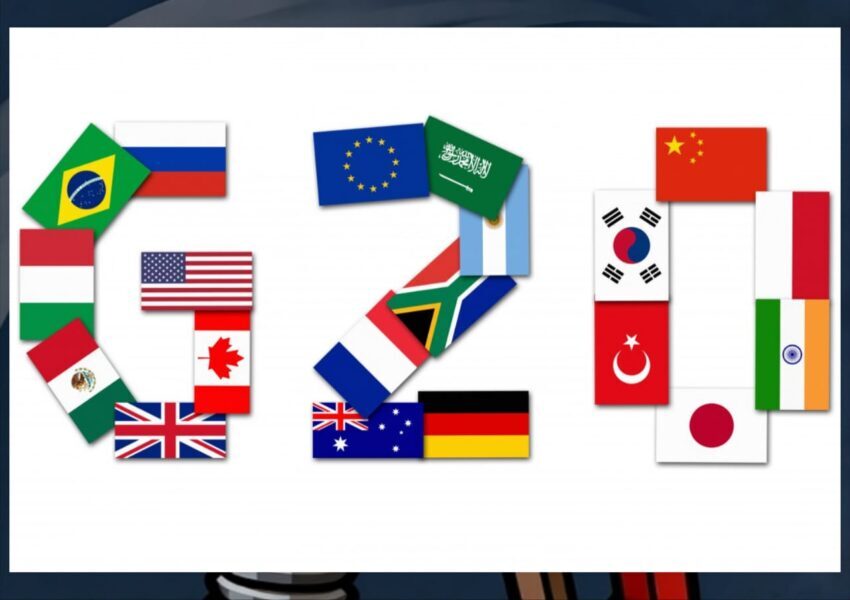

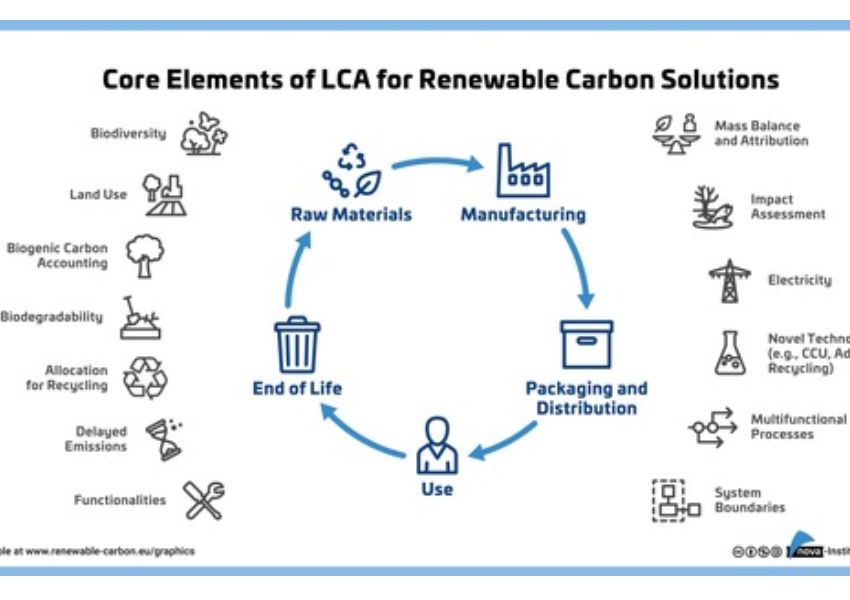

India’s proposal for the local collection of carbon taxes aimed for specific exports to the union is being considered by the European Union (EU). The Carbon Border Adjustment Mechanism (CBAM), which will go into effect on 1 January 2026, includes this procedure. Officials stress the necessity of thorough deliberations before making judgements, nevertheless. Indian exporters’ concerns, particularly those related to the reporting requirements for products with a high carbon content, have been allayed by the European Commission. This action, which was taken to address issues that surfaced during the CBAM’s initial phase, which started in October, is noteworthy.

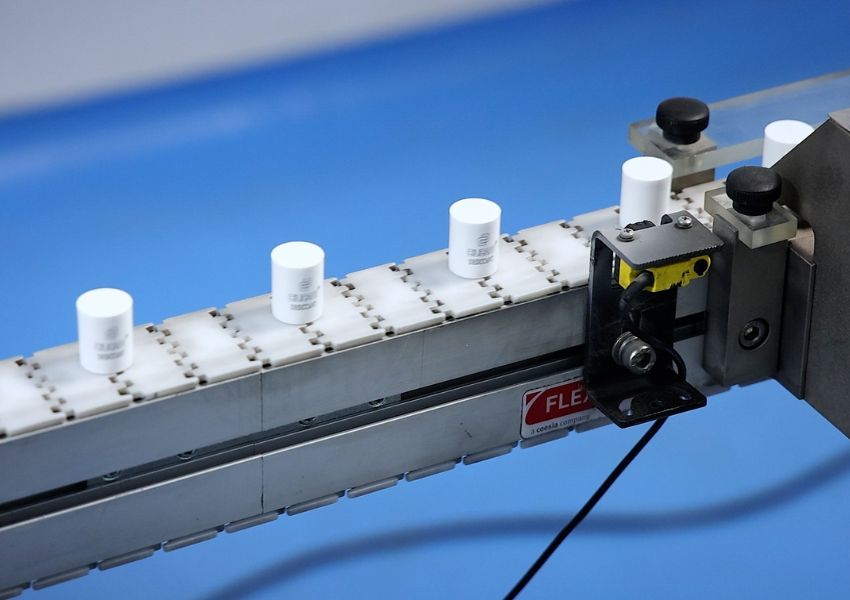

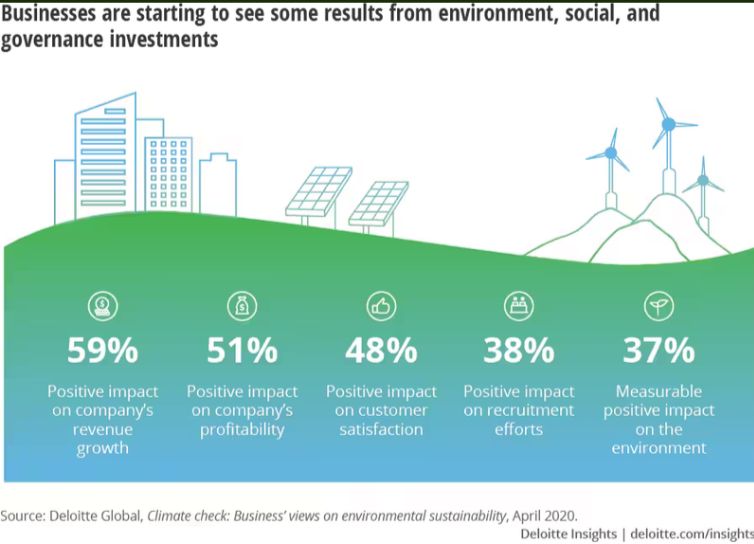

The EU’s CBAM programme attempts to appropriately price the carbon emissions generated when specific items are manufactured outside the EU. This might result in such commodities having higher import taxes starting in 2026. Although the EU already tracks its carbon emissions through the Emission Trading System, extra taxes of up to 20 to 35 per cent could be added on products like cement, iron, steel, and aluminium. Iron, steel, and aluminium, followed by cement, are among the Indian industries that could take the worst hit. India seeks EU approval to ensure most exporters comply and hopes to have a strong carbon credit trading system by 2026 to mitigate this.

In light of these improvements, exporters have until January 2024 to submit their first quarterly report outlining the CBAM products exported and the associated carbon emissions.