i.Riskman – Tech Mahindra Launches An ESG Risk Assessment Platform

i.Riskman is a centralized risk management platform aimed at empowering organizations to identify, assess, and manage climate-related risks

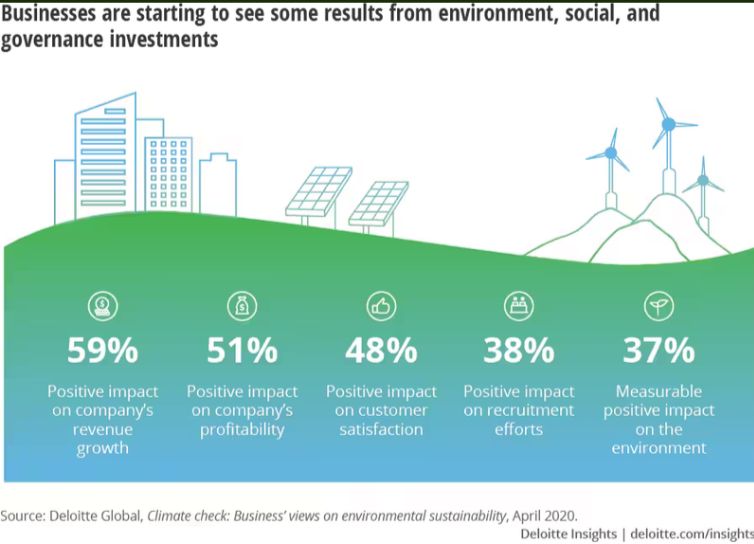

Tech Mahindra, a provider of digital transformation, consulting, and business re-engineering services and solutions, announced the launch of i.Riskman, an ESG (Environmental, Social and Governance) risk assessment platform designed to empower organizations to identify, assess, and manage climate-related risks. It provides a comprehensive solution to evaluate the impact of climate risks on business strategies, financial aspects, and overall risk exposure.

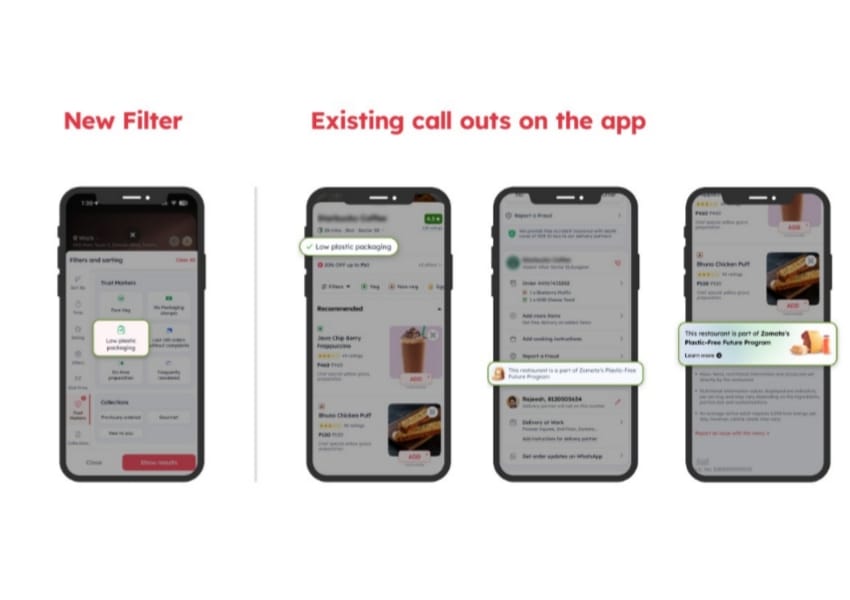

i.Riskman is a centralized platform for enterprise risk management that offers an automated risk register as a point of reference for the risk management committee and the board. It is designed to be flexible, agile and scalable, adapting to evolving and expanding risks. Additionally, the platform will empower Tech Mahindra’s customers with real-time analysis, access to the latest climate models, advanced data visualization, and analytics. This will provide them with a comprehensive and automated view of their climate-related risk landscape, enabling them to manage the financial impact of climate risks with up to 95 per cent accuracy.

Sandeep Chandna, Chief Sustainability Officer, Tech Mahindra, said, “In today’s rapidly changing business environment, climate risks can significantly impact an organization’s operations, assets, and supply chain. To help them tackle this challenge, Tech Mahindra is leveraging its sustainability and risk management expertise to offer a solution that transforms data into valuable ESG risk management insights. We are positive that i.Riskman will give our customers an overall risk landscape view, allowing them to proactively mitigate climate risks and make informed decisions supporting sustainable growth.”

The platform can be easily navigated and used by users with varying levels of expertise and backgrounds in an organization, promoting transparency and enabling effective collaboration among stakeholders involved in the risk management process.