IIFCL Plans To Generate INR 2,000 Crore Via Green Bonds

As of December 2023, the company profits Rs 1,189 crore, with loan sanctions totalling Rs 30,315 crore, surpassing the figures from the previous fiscal year in just three quarters

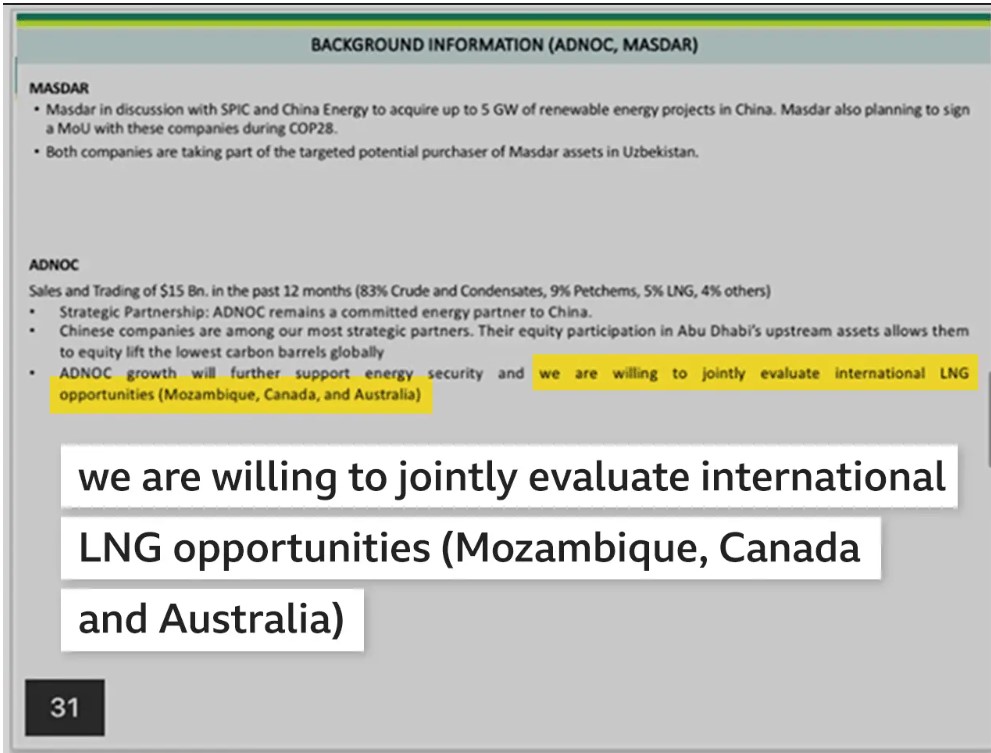

To finance sustainable projects, India Infrastructure Finance Company (IIFCL) plans to raise Rs 2,000 crore in the next six months, marking its debut in the green bond market. The IIFCL’s managing director, P.R. Jaishankar, presented the fundraising plan and hinted at a possible combination of local and international issuances, subject to funding costs. Jaishankar specifically stated that yen-denominated green bonds would be investigated, perhaps in the current quarter or the first quarter of the next fiscal year.

Jaishankar talked about the importance of sustainable green bonds in the areas of focus for IIFCL. The yen was mentioned as a crucial currency to be taken into consideration. Hedging and total borrowing costs are two cost-effectiveness considerations that will ultimately determine the currency choice. If a more advantageous option is available domestically, that will be prioritised; otherwise, the yen may be chosen for better returns.

This calculated action is in line with IIFCL’s overarching objective of expanding the proportion of green projects in its overall portfolio mix and diversifying its borrowing portfolio. The move comes after the State Bank of India’s (SBI) recent achievement in raising USD 250 million (about Rs 2,000 crore) through the private offering of green bonds with a 2028 maturity.

Jaishankar expressed confidence in IIFCL’s performance and predicted a profit for the fiscal year 2024 that will surpass Rs 1,500 crore. Due to a decrease in bad loans and an increase in lending, the company’s standalone net profit in the fiscal year 2023 climbed by a significant double to Rs 1,076 crore. Notably, IIFCL disbursed Rs 13,826 crore and attained record sanctions of Rs 29,171 crore.

In just three quarters, the company has surpassed the previous fiscal year’s records, with a profit of Rs 1,189 crore as of December 2023 and loan sanctions of Rs 30,315 crore. According to Jaishankar, there will be strong demand since the loan sanction amount is expected to surpass Rs 40,000 crore by March 2024.

Jaishankar emphasised the need for changes to advance the infrastructure sector and emphasised the critical role that IIFCL will play in providing funding for the next stage of infrastructure growth. The company’s gross non-performing assets (NPAs) and net NPA ratios have steadily decreased in spite of difficulties; as of 30 September, 2023, they were 3.77 per cent and 0.85 per cent, respectively.