Sebi Proposes Expansion of Sustainable Finance in India’s Securities Market

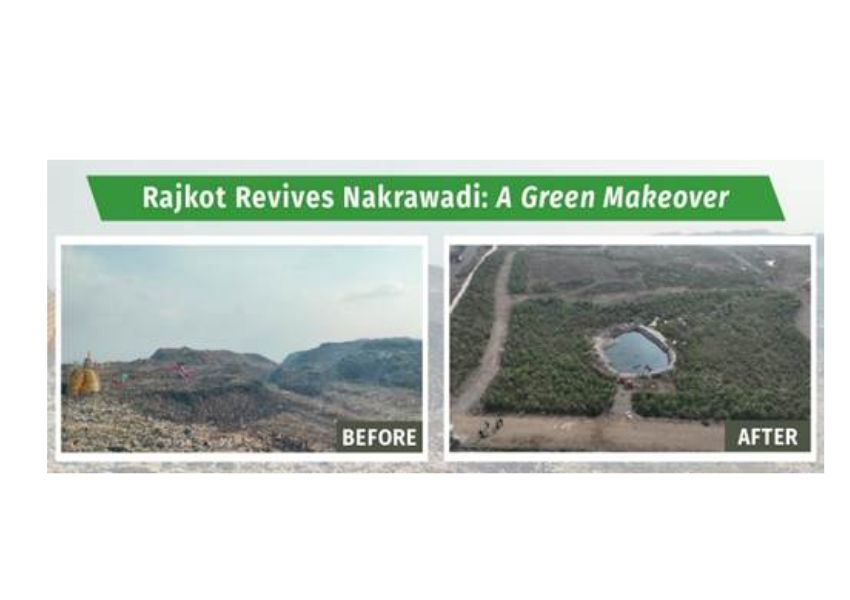

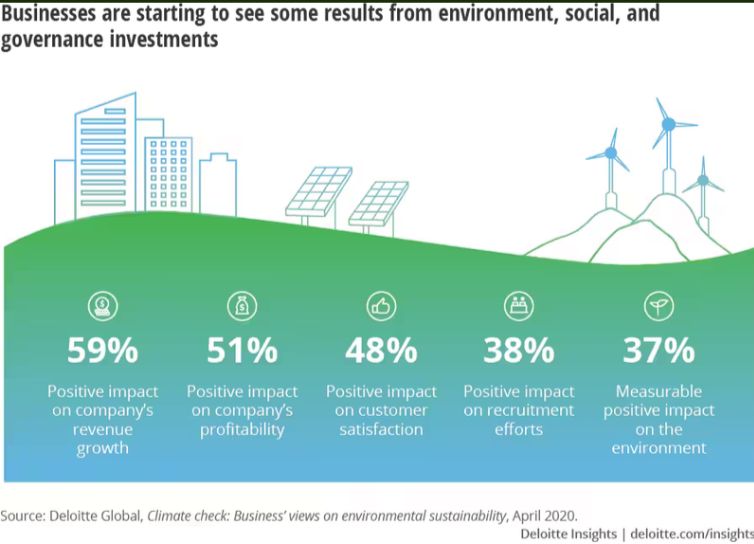

India’s market regulator, the Securities and Exchange Board of India (SEBI), has put forward a proposal to broaden the scope of sustainable finance within the country’s securities market. This move includes the introduction of a new investment product aimed at further embedding environmental, social, and governance (ESG) considerations into financial practices.

The key feature of this proposal is the introduction of “sustainable securitised debt instruments,” also referred to as green securitisation. SEBI defines these instruments as debt backed by sustainable finance credit facilities. Essentially, this means that the underlying assets supporting these instruments must align with sustainability goals, promoting responsible investment practices.

In addition to the existing green debt securities, SEBI’s proposal outlines that issuers could also raise funds through other types of bonds, such as social bonds, sustainable bonds, and sustainability-linked bonds. This expansion offers more avenues for companies to secure funding while adhering to ESG principles.

Sustainable finance, as defined by SEBI, involves the integration of ESG factors into financial decision-making processes. By broadening the framework, SEBI aims to encourage more investors and issuers to prioritize sustainability in their financial activities, contributing to the overall goal of a more sustainable economy. (With Reuters input)