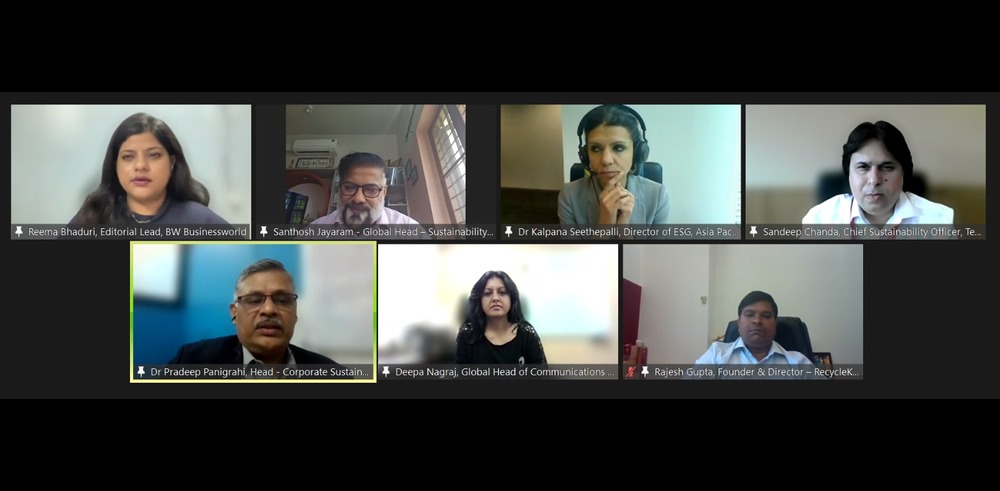

Standardised ESG Reporting Vital For Transparency, Innovation: Experts

Sector-specific frameworks are key to overcoming environmental, social, and governance (ESG) data challenges, experts note

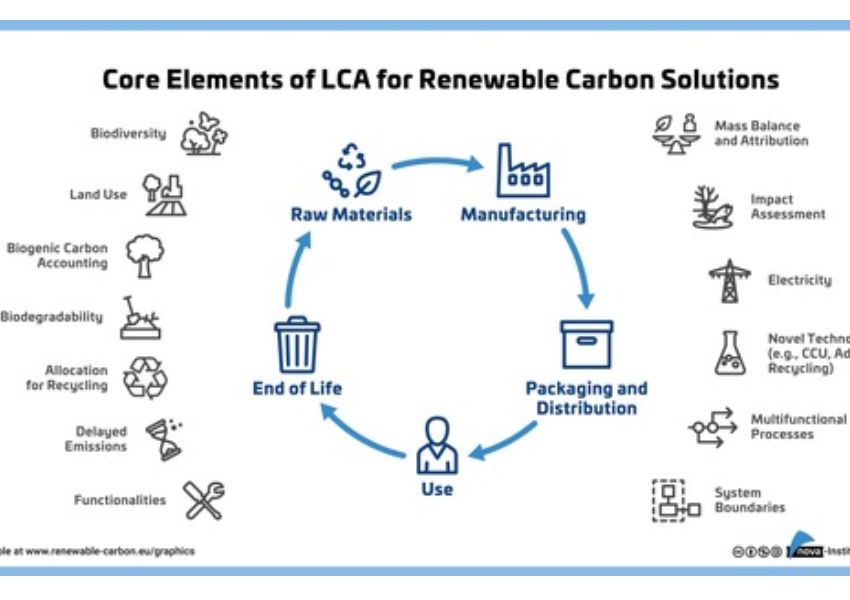

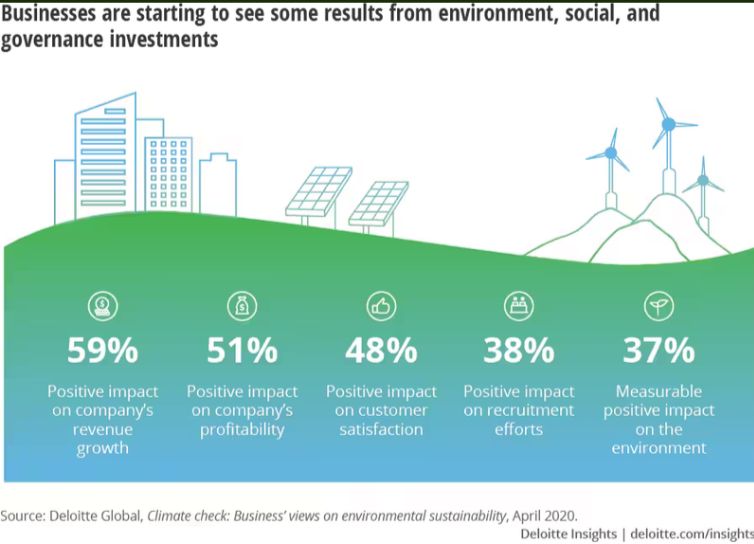

As environmental, social, and governance (ESG) considerations increasingly shape investment decisions, experts are calling for standardised ESG reporting to boost transparency and drive innovation. They emphasised the urgent need for consistent and comparable metrics to facilitate informed decision-making, mitigate greenwashing risks and unlock sustainable growth opportunities.

In the present times, businesses are struggling with various frameworks and guidelines, often finding themselves overwhelmed by the sheer volume of reporting requirements. While regulations such as the Business Responsibility and Sustainability Reporting (BRSR) have made progress in India, there remains a global need for unified reporting standards to ensure transparency, consistency, and comparability across industries.

The Need For Standardisation In ESG Reporting

“While standardised ESG reporting would go a long way in addressing transparency, the global landscape is still evolving, and achieving consensus is challenging,” explained Sangeeta Robinson, Chief Sustainability Officer, PVR Inox. Robinson highlighted the efforts made by the Securities and Exchange Board of India (Sebi) with the BRSR disclosures and noted that while India has made strides, global frameworks are still fragmented.

She noted that companies reporting on both Global Reporting Initiative (GRI) and BRSR frameworks face hurdles, as the evolving standards present complexity for reporting across multiple platforms.

While stressing the importance of global frameworks like the GRI, Monika Shrivastava, Head-Sustainability, JSW Cement said, “GRI remains one of the master frameworks guiding companies in reporting their sustainability metrics,” Shrivastava said.

Shrivastava added that while frameworks are improving, many parameters, especially in the BRSR, lack clarity, such as how to calculate the engagement of 75 per cent of value chain partners. This, she noted, is an ongoing challenge for companies striving to meet ESG goals.

Sector-specific Challenges In ESG Reporting

According to the experts, universal reporting standards are important and they help create a common language understood by investors, analysts, and stakeholders. It also provides investors with confidence in the authenticity of ESG data.

“Universal standards offer comparability, allowing investors to make informed decisions,” said Rahul Matta, General Manager, EOHS and Sustainability, Tata Communications. Matta explained that while BRSR offers a local perspective, international standards allow companies to address a broader range of stakeholder concerns, providing a holistic view of a company’s sustainability efforts.

Shrivastava added that sector-specific reporting plays a critical role, particularly in industries like cement, which face unique environmental challenges. “In the cement industry, CO2 emissions are a top concern, and failing to report that data would be a major oversight,” she said. Shrivastava highlighted that sector associations play a crucial role in setting KPIs and guiding companies on what is most material for their industry. “Different sectors have different priorities, and companies must know what KPIs are critical to their stakeholders,” she stressed.

The Future Of ESG Reporting

When discussing the future of ESG reporting in India, Matta pointed out that the BRSR is evolving, and regulations are becoming more stringent. “The neck is tightening,” he said, explaining that future iterations of the BRSR might require even greater transparency, including supplier data. He predicted that as the framework tightens, it will lead to greater innovation, credibility, and transparency in ESG reporting.

Shrivastava agreed, adding that standardisation and stricter regulations will push companies towards greater authenticity. “When consumers learn that producing one smartphone requires 12,000 litre of water, it brings a level of accountability that forces companies to be more transparent,” she said. Shrivastava noted that as consumers become more aware of environmental impacts, companies will need to be more honest in their reporting, driving further innovation in sustainability practices.

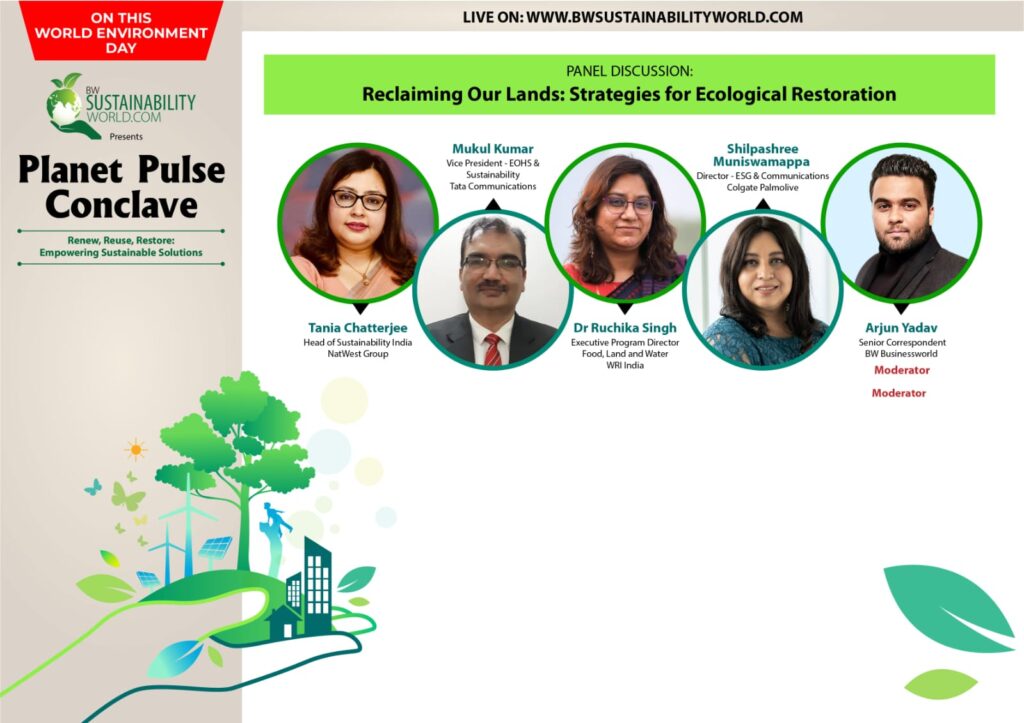

The experts agreed that standardised ESG reporting is essential for ensuring transparency and driving innovation across sectors. By adopting universal frameworks, companies can align with investor expectations and global sustainability goals. However, sector-specific challenges must be addressed to ensure that reporting frameworks are meaningful and reflective of each industry’s unique needs.Experts were speaking at the sixth edition of Sustainable World Conclave 2024.