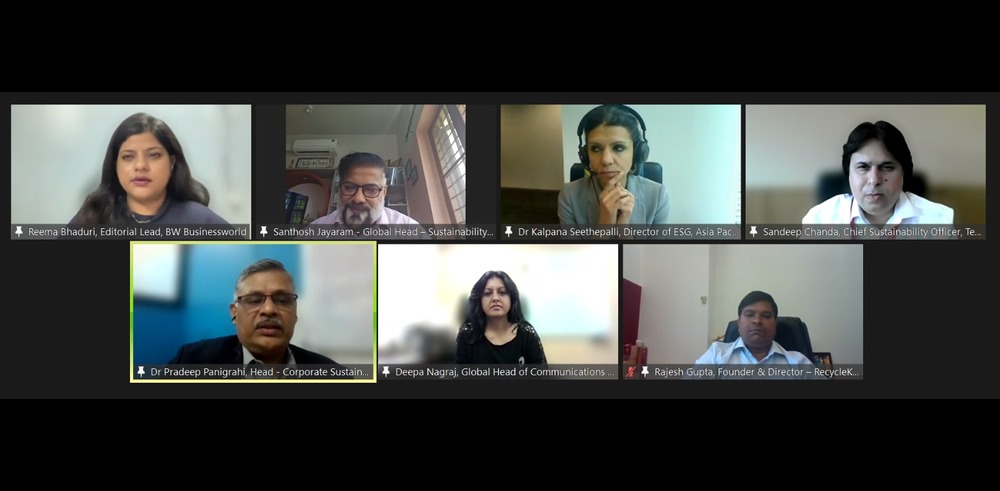

Striking A Balance: ESG Investing In India Navigates Profitability And Sustainability In The Emerging Market

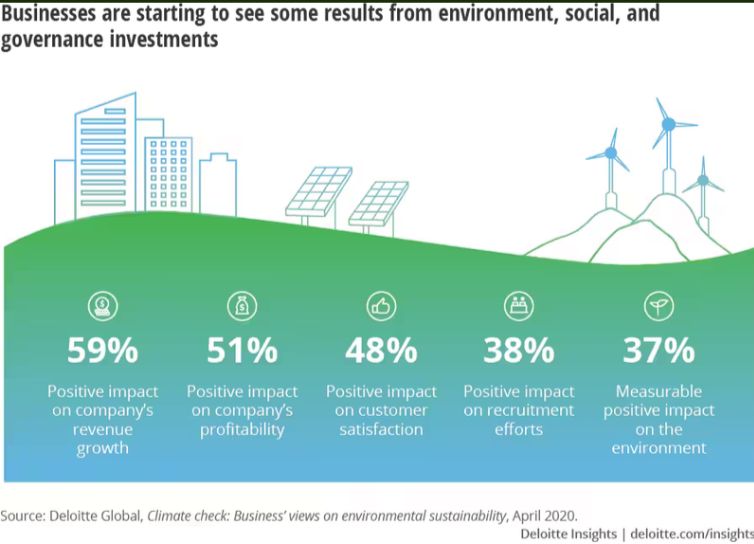

The arena of ESG investing in India has changed, with more companies recognising the importance of aligning sustainability with profits into their business strategies

In order to balance financial and environmental goals and eventually improve the nation, environmental, social, and governance (ESG) measures have become increasingly important. Due to sustained government investment and growing public awareness, ESG concepts are becoming increasingly popular in the context of the Indian stock market. People are choosing investments and products that are both environmentally and financially sustainable, which is a clear indication of the shift towards more sustainable options.

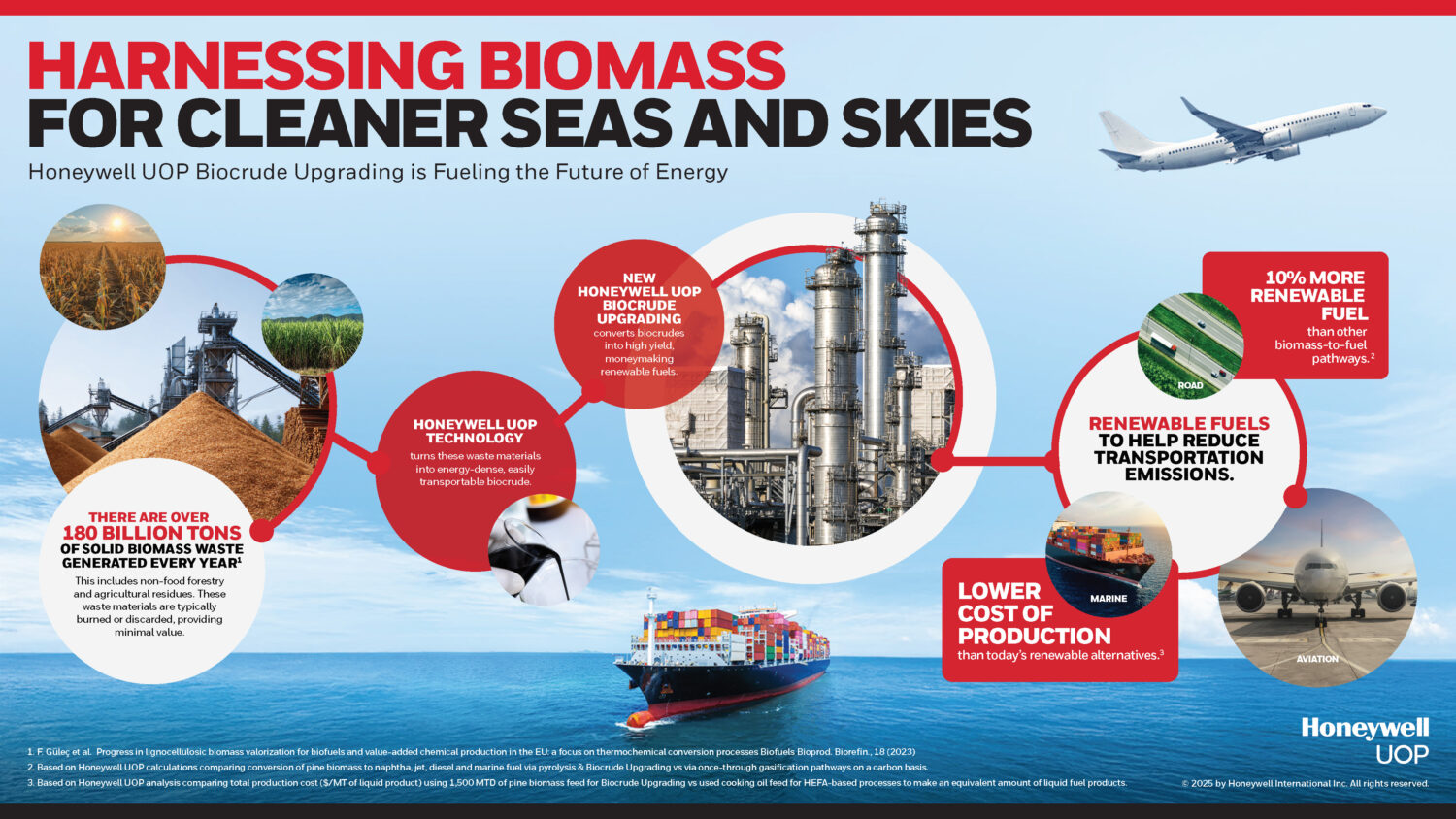

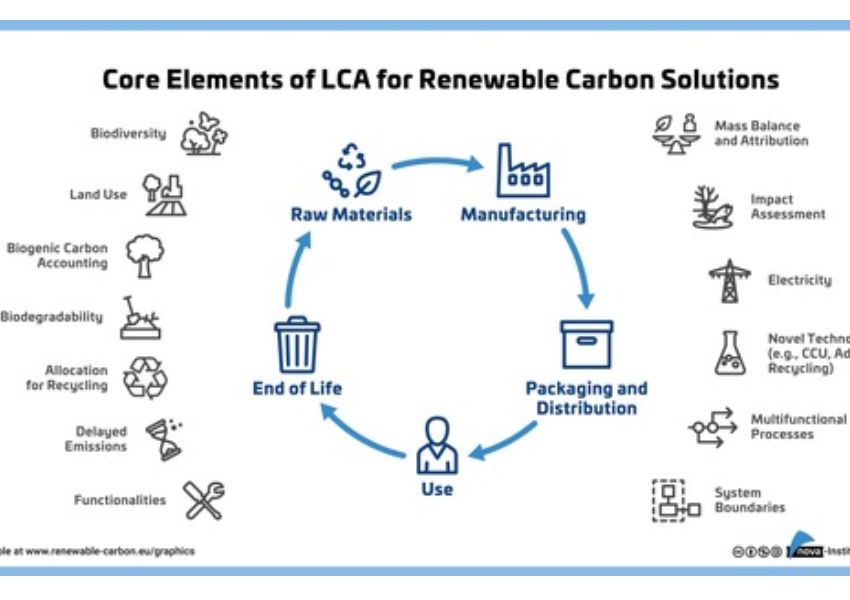

The endeavour to strike a balance between sustainability and earnings pushes businesses to reconsider their methods. The focus is on protecting the environment while growth and globalisation continue. Investors now favour companies that take proactive measures to preserve the environment, which has had a significant impact on the stock market. The relationship between environmental and financial stability is highlighted by elements like the adoption of new environmental regulations and the use of cutting-edge technologies.

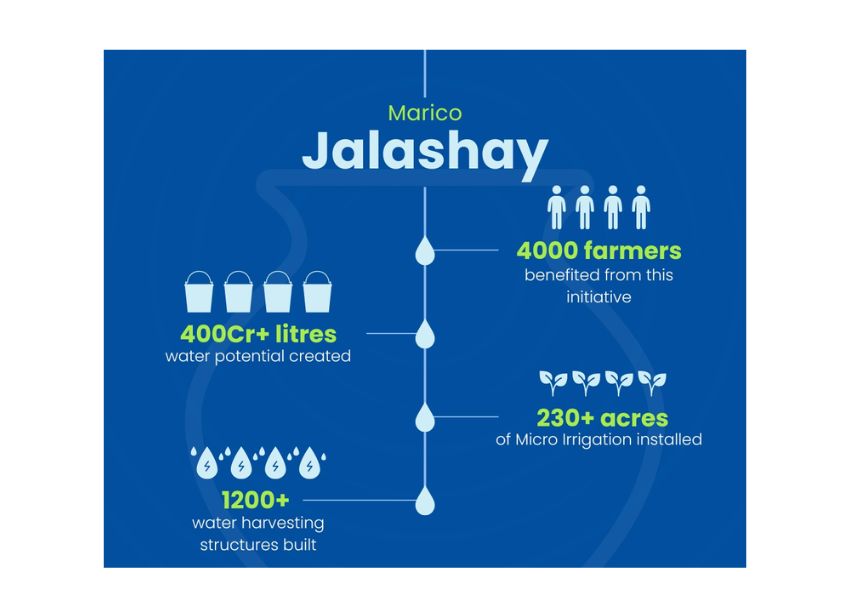

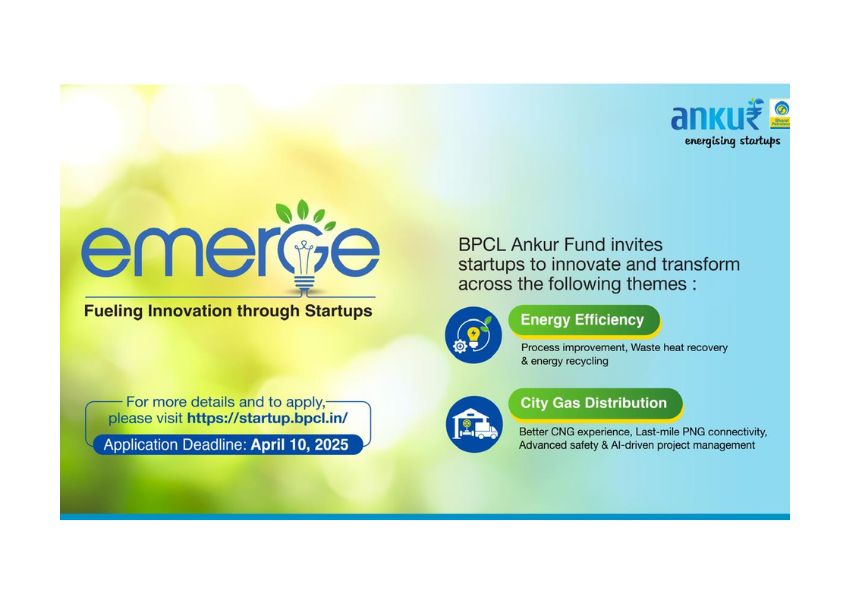

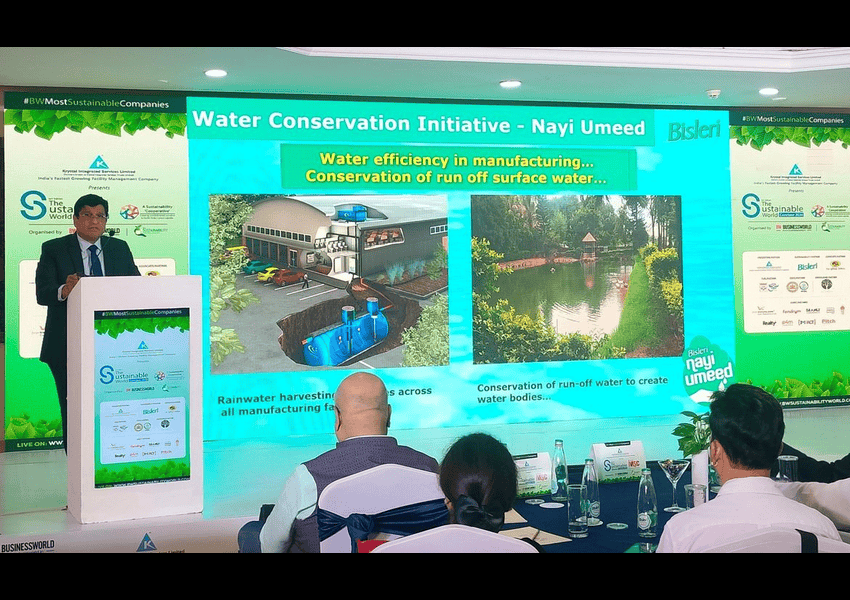

India is developing at a rapid pace, and both individuals and businesses are actively looking for ways to combine financial objectives with environmental ideals. One way to make an impact is to invest in businesses that envisage a sustainable future or integrate innovative technologies. One such example is the emphasis on renewable energy resources, which has attracted investors who are eager to support businesses that share this goal. ESG investors hold a crucial position in persuading businesses to recast their plans in a way that aligns profits and sustainability. This involves giving energy conservation, green technology, waste reduction, E-waste management, and regulatory compliance top priority.

A nation’s economic resilience is acknowledged to be significantly influenced by social responsibility. Businesses in India are becoming more conscious of and responsive to their social obligations. ESG investors keep a careful eye on these initiatives, which results in sizeable investments in blue-chip businesses that follow labour regulations, put employee welfare first, and support community development. In addition to improving a company’s reputation, a dedication to diversity, inclusiveness, and community development projects draws long-term investors and promotes economic stability.

Transparency, accountability, and ethical behaviour are highly valued by investors, and ethical behaviour and governance are essential to sustainable corporate operations. Strong corporate governance is seen as a defence against financial fraud, and ESG investors assess things like CEO compensation, diversity on the board, and shareholder rights to make sure that these things are in line with moral principles.

The landscape of ESG investing in India has evolved, with companies increasingly recognizing the importance of integrating sustainability into their business strategies. The BSE (Bombay Stock Exchange) and NSE (National Stock Exchange) have introduced ESG indices, offering investors criteria to assess the ESG performance of listed companies. This development signifies a shift in the Indian stock market towards greater sustainability and responsibility, reflecting a broader commitment to environmental, social, and governance principles.