UK Carbon Tax Casts Shadow On India’s Exports

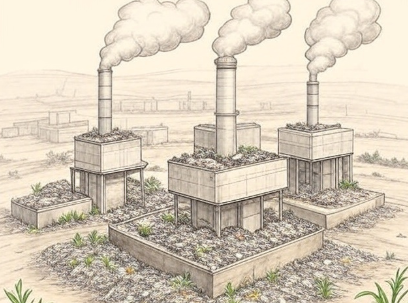

The Global Trade Research Initiative (GTRI), an economic think tank, has cautioned that crucial sectors such as iron, steel, aluminium, fertilisers, and cement will bear the brunt of this carbon tax

The United Kingdom revealed intentions on December 18 to implement a Carbon Border Adjustment Mechanism (CBAM) in 2027, a calculated move that could change the course of the economy. With this potentially disruptive decision, India’s USD 775 million in exports to the UK stand to lose a great deal.

Renowned economic think tank Global Trade Research Initiative (GTRI) has issued a warning, stating that important industries including cement, steel, iron, and aluminium will be hardest hit by this carbon price. The UK intends to address carbon leakage and level the playing field for domestic producers. It is scheduled to become the second economy after the European Union (EU) to implement CBAM.

According to the GTRI analysis, Indian exports worth USD775 million to the UK could be hit by the CBAM tax. Among the products at risk are iron (USD565.7 million), steel, aluminium (USD101.5 million), ceramics (82.8 million), and glass (USD25 million). This has a major impact on India’s trading environment and accounts for 6.8 per cent of all exports to the UK.

Co-Founder of GTRI Ajay Srivastava underlined the potential severity of the tax based on the full phase-out of free allowances under the Emission Trading System (ETS), which may be between 14 and 24 per cent of the import value. The main goal of the UK government is to stop carbon leakage, a practice in which businesses move their operations to nations with less stringent environmental laws in order to avoid paying UK carbon taxes.

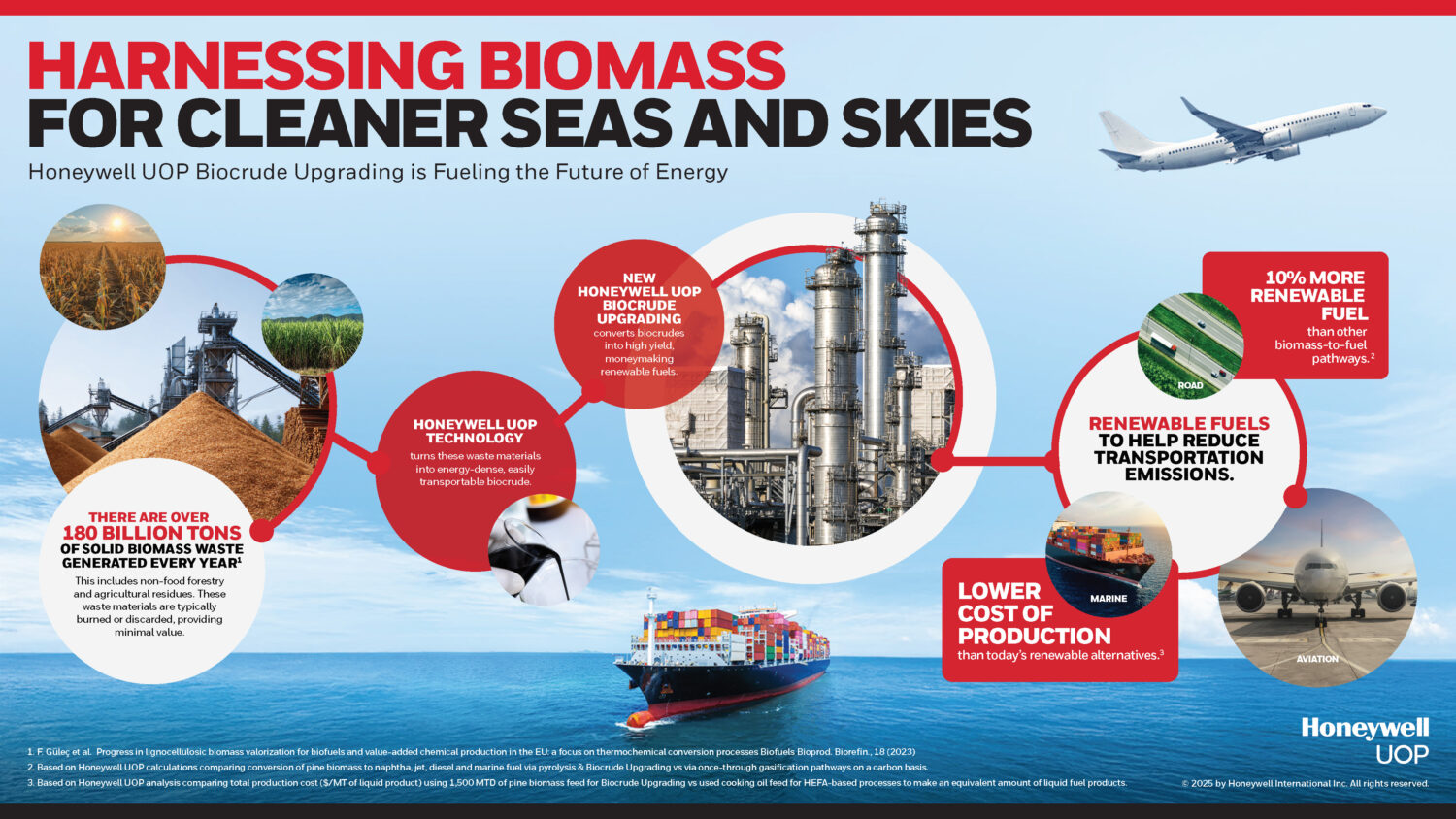

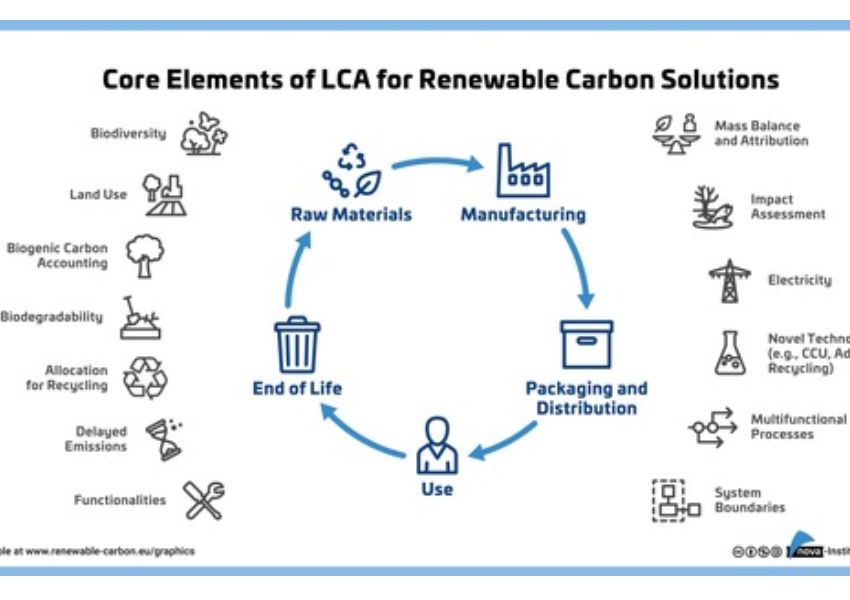

The projected carbon emissions generated during the production of imported goods will be the basis for determining their taxation. However, this tax will not apply to nations with carbon pricing plans comparable to the UK’s. The CBAM will operate in conjunction with the current UK ETS, which is one of the ETS systems that the EU and the UK have put in place to control greenhouse gas emissions.

Apart from replicating the EU model, the UK is investigating measures including optional product standards and a system to calculate the carbon footprint of products. These actions are in line with the overarching objective of encouraging low-carbon goods and bolstering all-encompassing decarbonisation strategies.

As the UK moves ahead with these transformative changes, the international business community, including India, faces the challenge of adapting to a carbon-conscious trade landscape that prioritises environmental sustainability and fair competition. The repercussions of the UK’s Carbon Border Adjustment Mechanism are poised to reverberate across the global economic stage, leaving nations and industries on high alert.