“We Have Raised $1 billion, We Are Raising Another $700 Million Which Should Happen By End March” – Varun Gupta, CIO, SAEL

SAEL – Sustainable and Affordable Energy For Life – is a company involved in renewable energy, focusing on solar and Agri-waste-to-energy projects. The company has raised $1 billion from marquee investors and is looking to close to another investment of $700 million by the end of March.

In a recent interaction with BW Businessworld, Varun Gupta, CIO & Head of Corporate Development, SAEL, explained to us how the company has been making its way in the energy sector and how it is trying to solve the problem of pollution in Northern India through Agri-waste-to-energy business segment.

Question: Could you give us a more detailed approach to how SAEL is entering the energy space or how they started their journey? What are the different business verticals of SAEL?

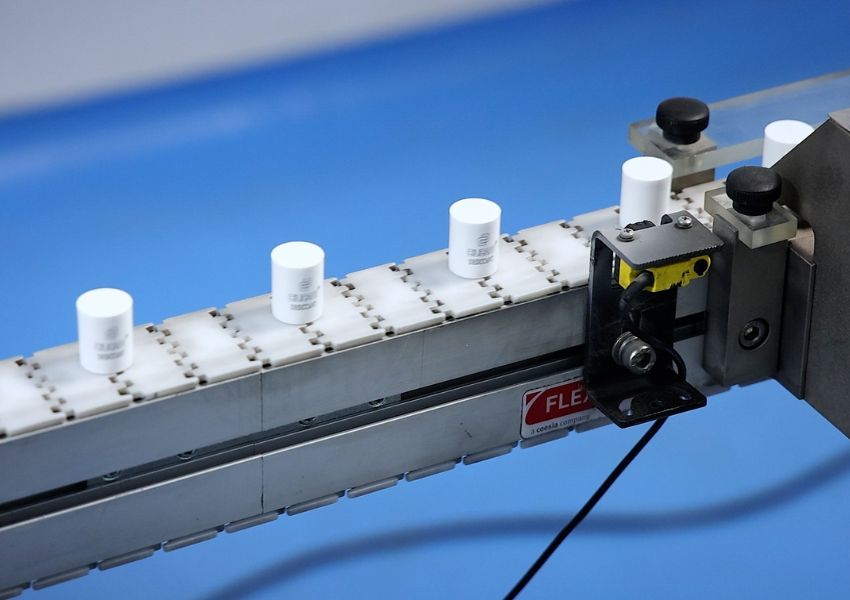

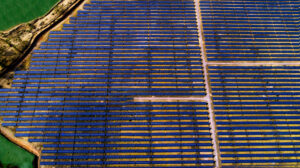

SAEL operates through four distinct verticals. Firstly, we undertake solar projects. Secondly, we engage in Agri-waste-to-energy projects, wherein we procure stubble from farmers to produce renewable energy. Thirdly, our EPC business involves the construction of renewable energy projects. Lastly, we have a module manufacturing business, which serves as a backward integration to our solar operations. Through this, we manufacture modules for our projects and also plan to export them in the future. Additionally, we are planning to further integrate backwards by venturing into cell manufacturing soon. This integration sets us apart as one of the few companies aiming for complete backward integration in the renewable energy sector.

SAEL operates through four distinct verticals. Firstly, we undertake solar projects. Secondly, we engage in Agri-waste-to-energy projects, wherein we procure stubble from farmers to produce renewable energy. Thirdly, our EPC business involves the construction of renewable energy projects. Lastly, we have a module manufacturing business, which serves as a backward integration to our solar operations. Through this, we manufacture modules for our projects and also plan to export them in the future. Additionally, we are planning to further integrate backwards by venturing into cell manufacturing soon. This integration sets us apart as one of the few companies aiming for complete backward integration in the renewable energy sector.

Question: You mentioned the Agri-waste business vertical where you are purchasing paddy straws from farmers. What is the entire process, and how is it impacting and benefiting the farmers?

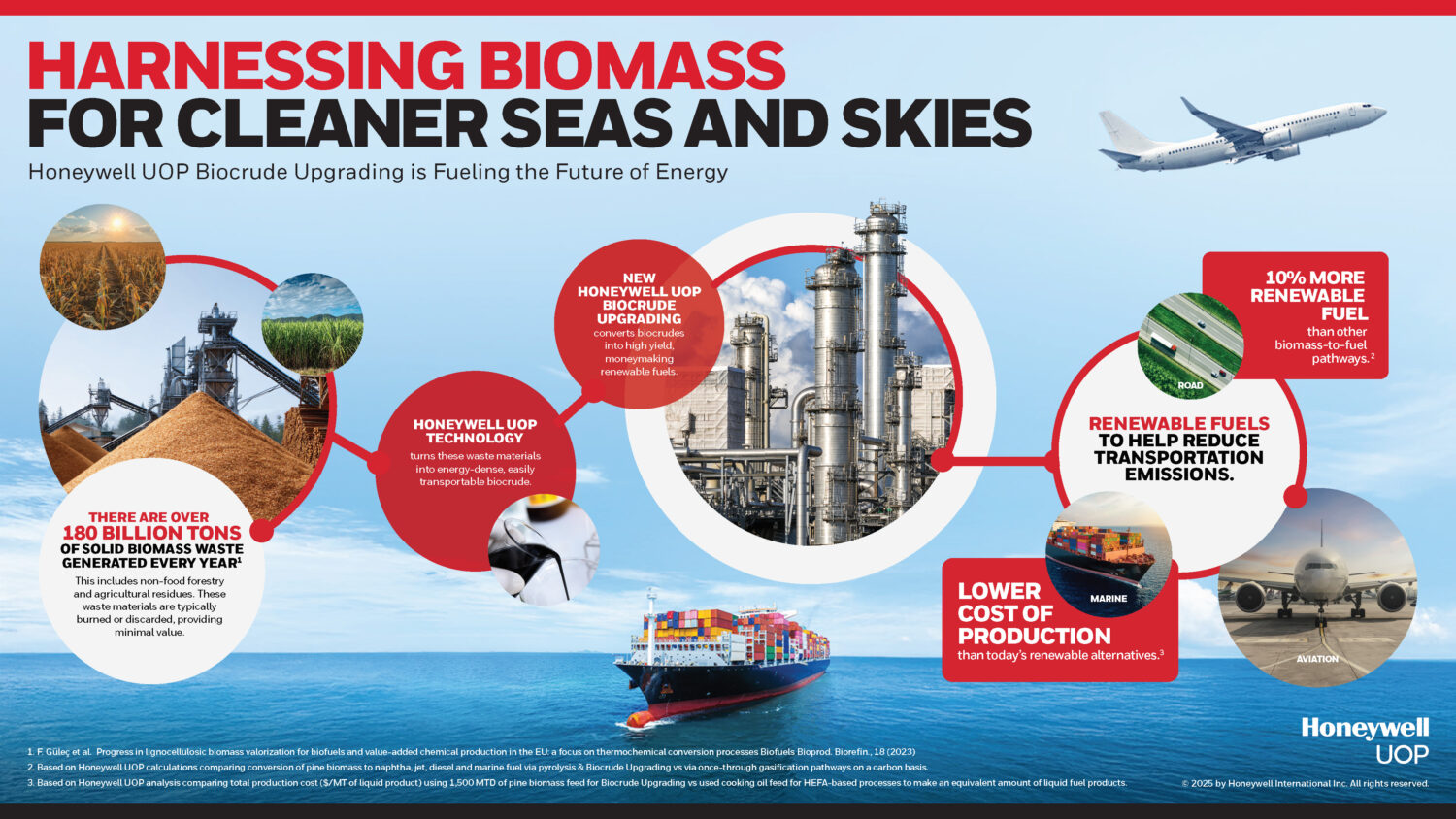

We are currently the largest Agri-waste to energy company in India. We commenced operations in 2019 with one project and have since expanded to 12 projects across Punjab, Haryana, and Rajasthan, with plans for further expansion into states like UP. Our unique approach involves acquiring technology from Denmark and optimizing boiler engineering for best-in-class plant operation. We purchase stubble from farmers, which would otherwise be burned during winter, contributing to pollution and health issues in Northern India. This practice affects nearly 600 million lives, particularly in densely populated states like Haryana, Punjab, eastern Rajasthan, and UP.

By offering farmers a source of income from stubble that would otherwise be disposed of at a cost, we alleviate financial burdens while directly reducing pollution levels. Implementing 400 – 500 MW worth of these projects in just the three states of Haryana, UP, and Punjab could significantly mitigate this issue. Stubble burning also depletes soil nutrient levels, leading farmers to rely more heavily on chemical fertilizers, which pollute groundwater and contribute to health issues like cancer. Moreover, the resulting smog during winter impacts tourism and public health, with pollution levels likened to smoking 40-50 cigarettes a day. Our technology presents a viable solution to this pressing problem, offering tangible benefits to both farmers and society at large.

Question: You mentioned obtaining paddy straws from the farmers. So, what is the carbon footprint of SAEL in that entire process?

When the stubble is burnt on land versus the stubble being burnt in boilers, there is a 98% reduction in emissions levels. This reduction includes carbon dioxide, carbon monoxide, and various other hazardous chemicals. There is a direct 98% reduction if it is burnt in our power project. Another benefit is that 50% of the revenue is passed on to the farmers, pumping money directly into the rural economy. One project caters to about 5000 farmers who supply paddy stubble to us. Another benefit for farmers is that they use their tractors and balers typically one or two months during the crop process, but because of the various collection centers we have, they end up using their equipment throughout the year to transport this stubble, after converting them into large bales, to our projects. It is also revenue-generating for them.

Question: Recently, SAEL was able to raise $1 billion through multiple partnerships where Norfund, ADB, DFC, & Tata Capital – Cleantech finance were involved. Climate finance has been a topic of conversation for many years now. Almost a decade ago, developed nations pledged to infuse $100 million every year into developing/emerging economies, but that has never happened. The maximum amount that developing nations have received so far is $85 million. Here we have SAEL, which has successfully raised $1 billion. So what is it that SAEL is doing differently and what can other companies in this space learn from you?

A lot of our focus is on the execution of projects. It is all about the capability to execute projects and projects performing as per business plans. Until you walk the talk and meet your commitments, it gives confidence to lenders, investors, etc. There has been a lot of focus within SAEL over the last year on corporate governance. So, until your execution and corporate governance are sorted along with a high-class team, you will be able to succeed in this business, which has huge potential. We have raised $1 billion, and we are raising another $700 million which should happen by the end of March. So, we would have raised $1.7 billion in 6 to 8 months. The four partners you mentioned are some of the partners in the chain and there are multiple others. These are high-class institutional investors, DFC (sovereign fund of the US), and Norfund (sovereign fund of Norway). We also have Aseem Infra, which is a subsidiary of the National Investment and Infrastructure Fund (NIIF), a sovereign fund of India. ADB is a marquee DFI. So, we have consciously focused on working with good partners from whom we can also learn because they have these kinds of projects all across the globe. So, a lot of knowledge sharing happens with them. Because of their pedigree, due diligence takes time, but we are happy to go through the process so that we are doing things in a proper manner. This approach that we have is not only about taking money and forgetting about it later. Our focus and mandate are that whatever we have committed, we need to perform.

A lot of our focus is on the execution of projects. It is all about the capability to execute projects and projects performing as per business plans. Until you walk the talk and meet your commitments, it gives confidence to lenders, investors, etc. There has been a lot of focus within SAEL over the last year on corporate governance. So, until your execution and corporate governance are sorted along with a high-class team, you will be able to succeed in this business, which has huge potential. We have raised $1 billion, and we are raising another $700 million which should happen by the end of March. So, we would have raised $1.7 billion in 6 to 8 months. The four partners you mentioned are some of the partners in the chain and there are multiple others. These are high-class institutional investors, DFC (sovereign fund of the US), and Norfund (sovereign fund of Norway). We also have Aseem Infra, which is a subsidiary of the National Investment and Infrastructure Fund (NIIF), a sovereign fund of India. ADB is a marquee DFI. So, we have consciously focused on working with good partners from whom we can also learn because they have these kinds of projects all across the globe. So, a lot of knowledge sharing happens with them. Because of their pedigree, due diligence takes time, but we are happy to go through the process so that we are doing things in a proper manner. This approach that we have is not only about taking money and forgetting about it later. Our focus and mandate are that whatever we have committed, we need to perform.

We try to be consistent with what we have articulated at the time of fundraising. We have been successful in doing that so far, and that is why more and more investors want to partner with us. We don’t have any organizational issues. There is no baggage that we have. From 500 MW two years back, we now have a 3200 MW project capacity, which is a six times growth. Similarly, we have a module manufacturing capacity of 2.3 GW, which is going to become operational in March. We promised a deadline of March, and if we commission in March, that gives confidence to investors. So, that is the main reason why we have been able to instil that confidence and able to get this kind of funding. And we are committed that when these projects become operational, we should stick to the targets we have given. To give you an example, on the waste-to-energy side, we committed 87% PLF. These projects are now performing at 91% PLF. At the event, the Norfund CEO mentioned that this is the first investee company that has beaten the base-case assumptions. We promised them 500 MW of implementation, and in the first year itself, we are going to do 3000 MW. Challenges will come, but you need to be transparent with your partners and take their help & knowledge in overcoming those challenges.

Question: What are some of the challenges that you have come across in the entire process of raising funds?

The initial challenge was (We are talking about big numbers here) to convince the investors about the ability of our team, our vision, our execution capability, etc. That took a considerable amount of time to build that confidence. Then partners started coming in, and we were performing well as well. As word of mouth spread, more investors and lenders started joining hands, and now they are all our partners. If we continue to perform like this, we can scale in the next 3-4 years. The sky is the limit when it comes to renewable. On the execution side, there is one specific challenge which will only become apparent in the coming times, which is land acquisition combined with evacuation. You need evacuation at a certain point, at a certain location, and you need to find large parcels of land just near it, which is a challenge since we have committed to comply with IFC & World Bank standards on ESG. Our ESG screening also has to be perfect on the same piece of land. This is the challenge that we are facing in one or two projects. Apart from that, most of our projects are in solar parks, which already come with land and evacuation. One unique feature of our portfolio is that nearly 70% of our portfolio, the off-takers are GUVL and SECI, best-in-class off-takers. They are AAA-rated off-takers, so the cash flow profile is going to be very strong once these off-takers start putting in cash.

Question: We know that you have been raising funds and invested a lot in technology. You talked about the Danish technology you have employed for burning the stubble you take from the farmers. One, how expensive is this technology, and is it easily accessible to different players in the market? And what more investment are you looking to make in the technology in the coming times?

Boilers have existed for decades. This is the most expensive boiler in boiler engineering because it is European. In India, typically, people avoid paying the high cost of technology. So, a lot of boilers came from China, and there was a lot of focus on thermal for Chinese boilers. We have BHEL doing boilers. We went to Europe because these boilers have been tried and tested across Europe for the last 40-50 years. Paddy stubble is a very different fuel with a very high silica content value so every boiler cannot burn it easily and then perform also. So you don’t want to have a situation where the project is operational and you are getting very low PLFs and you have some issues in the boiler every other day.

So we took this technology consciously which is very expensive but because they have a track record. Then we customized it for paddy stubble for which it took us nearly 3 years. And now there is a 5-year track record. There were a lot of learnings which happened along the way. There was not enough quality manpower to run these kinds of plants so a lot of talent development on the technical side was done in-house over the last few years. Engineering is very important for this kind of boiler. We now have an engineering team of about 50 people who specialize in this technology, and they are in constant touch with our Danish partners who keep on innovating and keep rectifying issues they face in boilers over time.

Question: In the coming years, what will SAEL’s focus be on sustainability and expansion?

We are not chasing MW as our competitors have been. That is not our focus. We are chasing high quality, stable EBITDA, or cash flow. Whatever assets we are building should be relatively risk-free and should generate cash flow for our stakeholders for 25-30 years. Right now, we are doing solar, waste-to-energy, and module manufacturing, there is huge potential to grow within these segments over the coming years. We are thinking of doing 2GW every year. But if after 2 years, it doesn’t make sense, then we are not going to push boundaries. Yes, we have to focus on sustainability, we should focus on how to make money out of it. So if we know the technology is not commercially viable, then we have to look for alternative technologies, solutions like RTCs, and solar storage.

Whatever assets we are building should be relatively risk-free and should generate cash flow for our stakeholders for 25-30 years. Right now, we are doing solar, waste-to-energy, and module manufacturing, there is huge potential to grow within these segments over the coming years. We are thinking of doing 2GW every year. But if after 2 years, it doesn’t make sense, then we are not going to push boundaries. Yes, we have to focus on sustainability, we should focus on how to make money out of it. So if we know the technology is not commercially viable, then we have to look for alternative technologies, solutions like RTCs, and solar storage.

We are already exploring solar storage, but the challenge there is that storage is available only for 4 hours. So there are a lot of innovations going on in that area so hopefully, we will have higher storage capacity in the coming years. With our combined portfolio of solar and waste-to-energy, we will shift our focus on solar storage and RTC as well. I think within 4-5 years if we can generate 10000 MW, then it will be the fastest growth that anyone would have seen in renewable energy.

Question: How do you see the climate financing space evolving for India in the coming years?

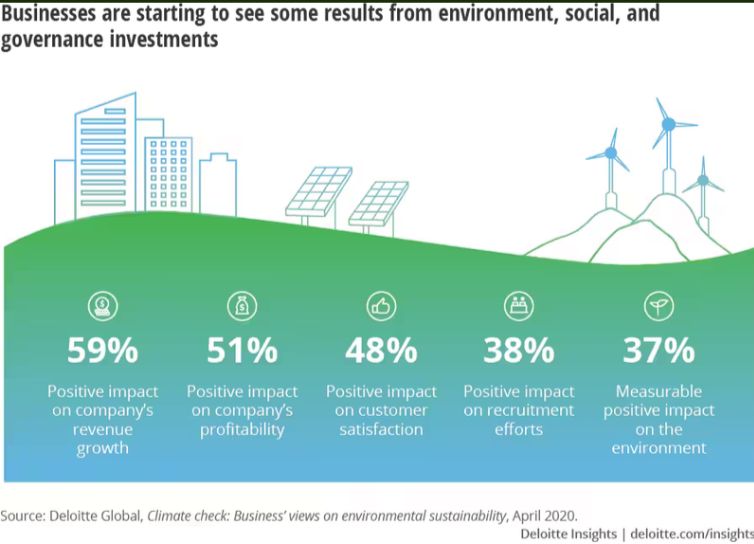

Ans. There are a lot of funds available for climate finance. Renewables are a growing sector. It provides sustainable cash flow, so investors and lenders have already figured it out and they want to put in money. Capital is not going to be an issue going forward. The speed of capital could be improved upon otherwise investors are chasing renewables. The only issue is that whenever we talk about new technology it takes a lot of time nearly 2-3 years to educate the lenders and investors and to get their comfort. It is a long lead cycle.

If you want to do 450,000 MW in the next 7 years, if I waste 2-3 years just explaining the technology for example solar storage – there is a discussion around it, but funds are not available for it in abundance today. They might get available in 3-4 years down the line. But if I want to put in a 1000 MW solar storage project, I don’t know how much time it will take to get it funded. So they are doing plain vanilla renewable as of now. You will be surprised that foreign lenders & investors are faster in their process of understanding the technology, risk and mitigants. It is the Indian lenders who take more time compared to the foreign lenders.

Question: Why are the Indian lenders hesitant?

They are hesitant because they have burnt their hands in some of their fossil fuel technologies. So they have faced a lot of issues in thermal power specifically. So that’s the reason why they are more careful. That is good in a way, but the timing should improve. Foreign institutions go and sit on the projects themselves. They go on the ground and study technology and issues, etc. So they spend more time on the ground in understanding issues which is why they are faster in backing technology. Today, we are doing green hydrogen. I don’t know if any Indian lender will fund it. So we will start with ADB, DFI understanding it properly, funding it, and experimenting with it. And if they are successful then hopefully the Indian lenders will step in.